RNC Pharma: March Heavily Influences Online Sales of Veterinary Drugs

In Q1 2024, 1.8 billion rubles’ worth of nebulizers were sold on the Russian retail market (retail prices, VAT included), up 38% from Q1 2023. In physical terms, 752,000 devices were sold, up 51% from the same period in 2023. In 2023, however, 4.9 billion rubles’ worth of nebulizers were sold, up by only 0.5% in rubles and by 10% in units from 2022. The product range has been changing, which affects the average price—it was 2,390 rubles in Q1 2024 against 2,610 in Q1 2023. As well as for almost any other category of medical devices, the price index for nebulizers was negative. In Q1 2024, the prices began to rise, with an inflation rate of 3.3%.

The online sales of nebulizers in Q1 2024 accounted for around 32% of the total sales. In physical terms, it was 45% against 33% in Q1 2023. The growth rates of the online channel exceed those of the offline segment—the online sales went up 63% in rubles and doubled in units, while the offline sales rose 29% in monetary and 25% in physical terms.

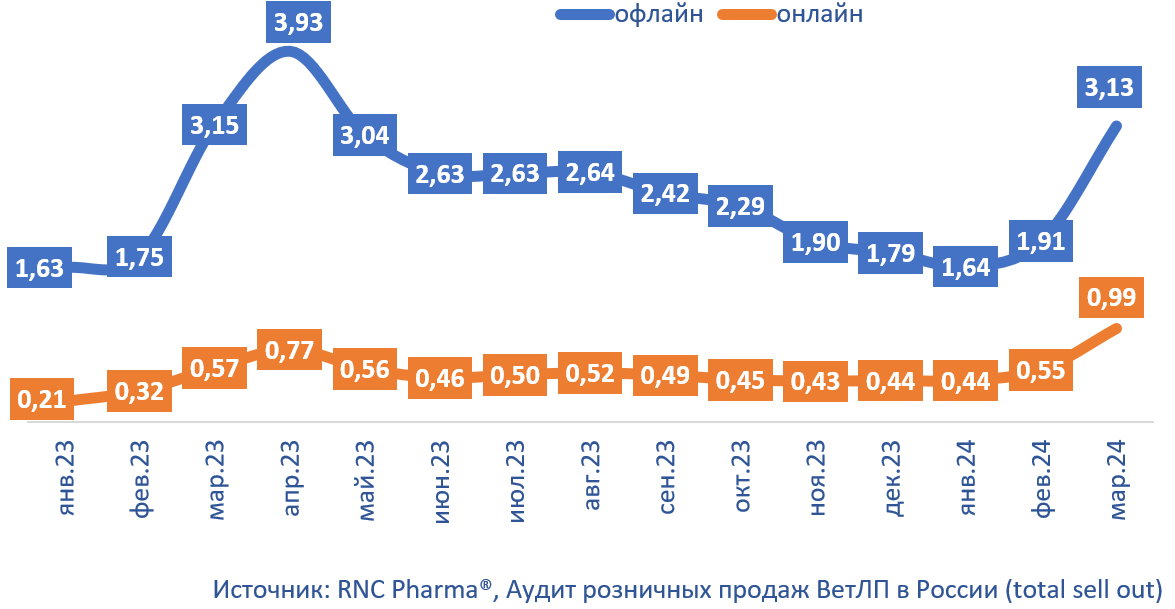

In March, many regions of Russia usually see the demand for certain groups of veterinary drugs grow. This year, however, the offline sales fell 0.4% in rubles from March 2023, but grew 4.8% in MDUs. At the same time, the online sales went up 73% in monetary and 44% in physical terms. In total, 22.7 million MDUs worth 4.1 billion rubles were sold on the retail market in March.

In January–March 2024, products of around 1,590 veterinary brands were sold both offline and online. At the same time, the number of brands sold online was noticeably smaller—884, although it grew from 800 in Q1 2023. The number of brands sold offline, however, was 1,578, down 28 from Q1 2023.

Two American corporations were among the top three companies with the largest sales volumes—Zoetis (12.6% of the sales) and Elanco (11.5% of the sales); Slovenian KRKA rounds out the top three with 8.6%. Market leader Zoetis saw a modest 3% increase in sales in rubles from Q1 2023, while its sales in physical terms dropped 58%. The sales of Elanco fell 10% in physical terms but grew 28% in rubles. As for KRKA, the company saw positive growth rates in both rubles and MDUs—66% and 77%, respectively. Russian Ekoprom rose from seventh to fourth place, with growth rates of 62% in monetary and 36% in physical terms.

Among those companies that see a decline in sales, American MSD must by the most shocking example, falling from first to fifth place in the ranking. The company’s sales dropped by 41% in rubles and by 54% in MDUs.

Fig. Monthly growth rates of the Russian veterinary retail market (offline / online) in January 2023–March 2024 (billion RUB, retail prices, VAT included)

Рус

Рус