Pharmaceutical Drug Export from Russia in 2019

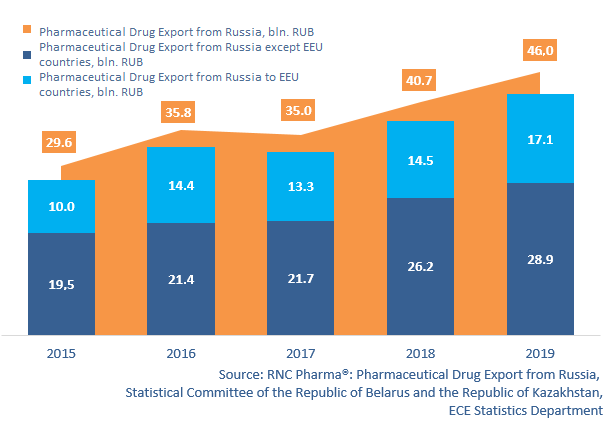

In 2019, Russia exported 46 bln RUB worth of pharmaceutical drugs (customs duties included), which is in monetary terms (rubles) 13% higher than that in 2018. The export volume in physical terms amounted to more than 0.95 bln units, with the dynamics of +17.9%.

The EEU countries (Belarus, Kazakhstan, Kyrgyzstan and Armenia) account for 37.1% of the total export in monetary terms (against 35.7% in 2018 and 40.1% in 2016), or 17.1 bln RUB.

In 2019, Russia exported to 109 different countries. The top 10 countries (post-Soviet republics and Nigeria) account for 80% of the export in monetary terms. Nigeria accounts for 4% of the export; in 2019, Russia exported only Yellow Fever Vaccine by Chumakov Federal Scientific Center for Research and Development of Immune and Biological Products of Russian Academy of Sciences. Among the 7 new export directions, Iran, working with Biocad, accounts for the highest export volume.

Ukraine remains the leader in export volume, accounting for 16.7% of the export in monetary terms (7.7 bln RUB). However, Donetsk People’s Republic and Luhank People’s Republic, where Russia mainly exports mass demand drugs of non-Russian origin, produced by more than 460 companies (Sanofi, TEVA, Novartis and Takeda among the largest), account for more than 96% of the export. Only a few Russian companies exported there, Stada (Hexicon, Livarol and others) and Mir Pharm (Phenybut) among them.

Lithuania (exports have grown by 57%) and Turkmenistan (41%) have the highest dynamics among the top 10 recipient countries. Biocad (Herticad, Bevacizumab and Genferon) and Geropharm (Cortexin and Retinalamin) actively exported to Lithuania, and Syntez exported a large number of antibacterials to Turkmenistan.

Exports to Uganda have grown by record-worthy 1000 times; in 2019, Russia exported 5.2 bln RUB worth of Yellow Fever Vaccine, Bevacuzumab, and Trastuzumab.

Dynamics of pharmaceutical drug export from Russia (including to the EEU countries), 2015 – 2019, customs duties included

Рус

Рус