Veterinary Vaccine Import to Russia (June and First Half of 2020)

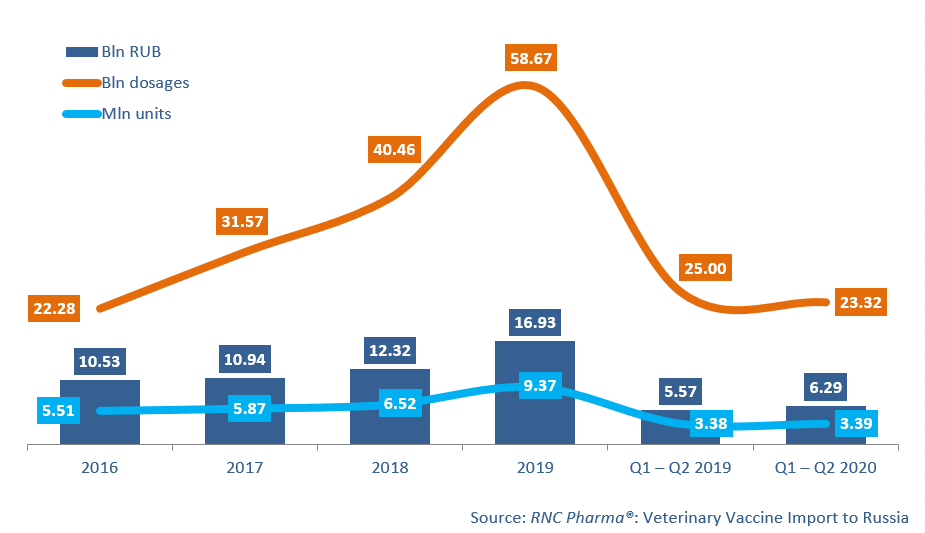

Between January and June 2020, Russia imported 6.29 bln RUB worth of veterinary vaccines (customs clearance included), which is in monetary terms (rubles) 13% higher than in 2019, even though the importers stocked up their warehouses in late 2019. The import volume of veterinary vaccines in 2019 has grown by more than 37%. In the first half of 2020, the import volume amounted to 3.39 mln units, with the dynamics of +0.4%. If calculated in dosages, the dynamics are -6.7%, and the import volume is 23.32 bln dosages.

Live vaccines account for the largest volume both in physical and monetary terms, with the dynamics of +39% in rubles. If calculated in dosages, the dynamics are -7.5%. As for inactivated vaccines, the dynamics are -12.6% in monetary and +28% in physical terms. Combined vaccines accounts for less than 0.02% of the total import volume in MDUs, but for as much as 7.4% in rubles, with the dynamics of +11% in monetary and +20% in physical terms.

MSD accounts for the biggest import volume of live vaccines, with 36% of the volume in monetary terms. The dynamics in rubles are +53%, which is, however, far from record-worthy, compared with Elanco (USA) and Biofarm (Czech). Elanco’s and Biofarm’s imports have grown by 2.5 and 2.2 times, respectively. Elanco was importing only their AviPro line, which includes five types of vaccines. Vaccines for the prevention of viral anemia in chicken, infectious bursal disease and Newcastle disease contributed to the dynamics the most. Biofarm’s import line was much narrower: the company was importing only Livacox, vaccine for the prevention of chicken coccidiosis.

Daesung Microbiological Labs (South Korea) and Pharmagal-Bio (Slovenia) have the highest dynamics of the import of inactivated vaccines (import grown by 3.9 and 3 times in monetary terms, respectively). Daesung Microbiological Labs was importing two vaccines, and Circo PigVac, vaccine for the prevention of circovirus infection in swine, was the one that contributed to the dynamics better. Pharmagal-Bio was importing only Rotagal, vaccine for the prevention of rotavirus, coronavirus infection and colibacillosis in cattle.

As for combined vaccines, Zoetis has the highest import dynamics (import grown by 2.4 times in monetary terms). The company was importing three trademarks, with CattleMaster contributing to the dynamics the most.

Dynamics of veterinary vaccine import to Russia (EEU countries excluded), free circulation prices (customs clearance and VAT included), 2016 – 2019, Q1 – Q2 2020, bln RUB

Рус

Рус