RNC Pharma: Nebulizer Retail Market Expands in Q1 2024, New Chinese Companies Enter

In Q1 2024, 1.8 billion rubles’ worth of nebulizers were sold on the Russian retail market (retail prices, VAT included), up 38% from Q1 2023. In physical terms, 752,000 devices were sold, up 51% from the same period in 2023. In 2023, however, 4.9 billion rubles’ worth of nebulizers were sold, up by only 0.5% in rubles and by 10% in units from 2022. The product range has been changing, which affects the average price—it was 2,390 rubles in Q1 2024 against 2,610 in Q1 2023. As well as for almost any other category of medical devices, the price index for nebulizers was negative. In Q1 2024, the prices began to rise, with an inflation rate of 3.3%.

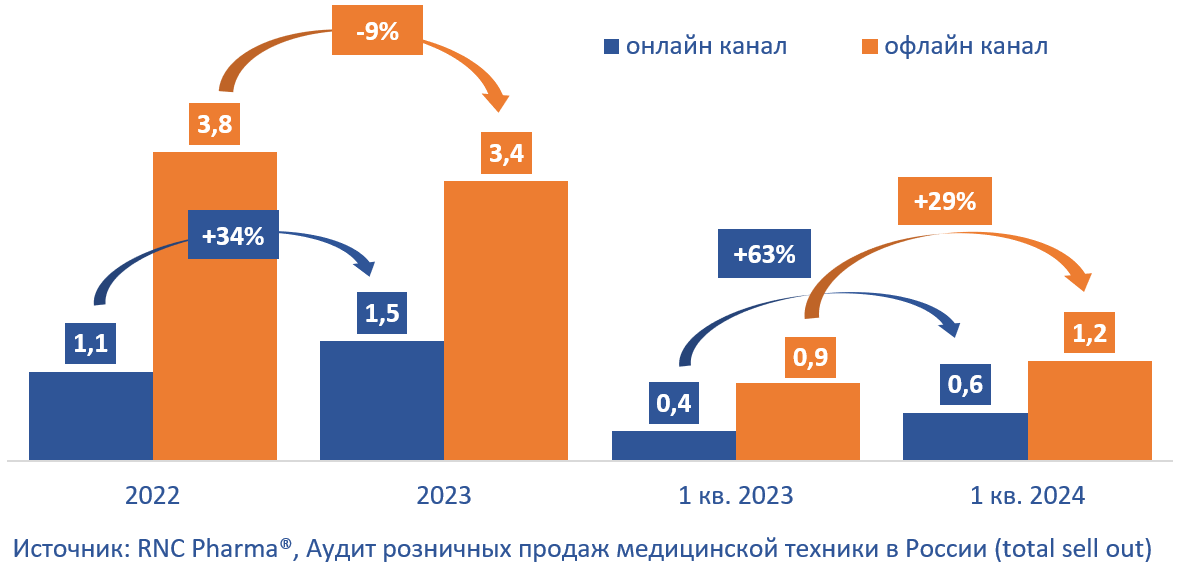

The online sales of nebulizers in Q1 2024 accounted for around 32% of the total sales. In physical terms, it was 45% against 33% in Q1 2023. The growth rates of the online channel exceed those of the offline segment—the online sales went up 63% in rubles and doubled in units, while the offline sales rose 29% in monetary and 25% in physical terms.

Japanese nebulizers are the most popular devices, accounting for more than 45% of the retail sales. Swiss and Singaporean devices accounted for 24% and 14% of the sales, respectively. Nebulizers of 44 brands from 10 countries were sold in Q1 2024. However, Russian devices accounted for only 0.2% of the sales in monetary terms. Devices of 39 companies were sold in the analyzed period; five did not sell in Q1 2023, and a few entered the market in the second half of 2023. The product range is expanding thanks to Chinese companies—three new manufacturers entered the market in Q1 2024.

TopLife was one of the new players—its IngaLife compressor nebulizers helped the company climb up to the eighth place in terms of sales in rubles, accounting for around 1% of the total sales. The sales of the other two Chinese companies accounted for only 0.06% of the total sales. Japanese Omron devices remain the most sold nebulizers—the sales account for 29%, followed by Swiss B.Well with 23% and Japanese A&D with 16%.

Chinese Glenmark Impex and Xiaomi Technology had the best growth rates among the top 10 companies—their sales went up 77% and 72% in monetary terms, respectively. The sales of A&D devices rose 70%.

Fig. Growth rates of the online and offline retail sales of nebulizers in Russia in 2022–2023 and Q1 2024, billion RUB

Рус

Рус