Ranking of Russian Pharmaceutical Distributors (Q1 — Q3 2019) November 13, 2019

The Russian pharmaceutical market is developing extremely unevenly in both individual market segments and specific product groups this year. Due to significant cash injections into the public sector, the dynamics in this segment is very different from that in the pharmaceutical retail. The latter is also close to stagnation, since the total dynamics in rubles does not exceed inflation indicators, despite being positive. The demand for pharmaceutical drugs is clearly falling, especially in the OTC category. As for parapharmaceuticals, the consumers are turning to the non-pharmacy segment, including online sale.

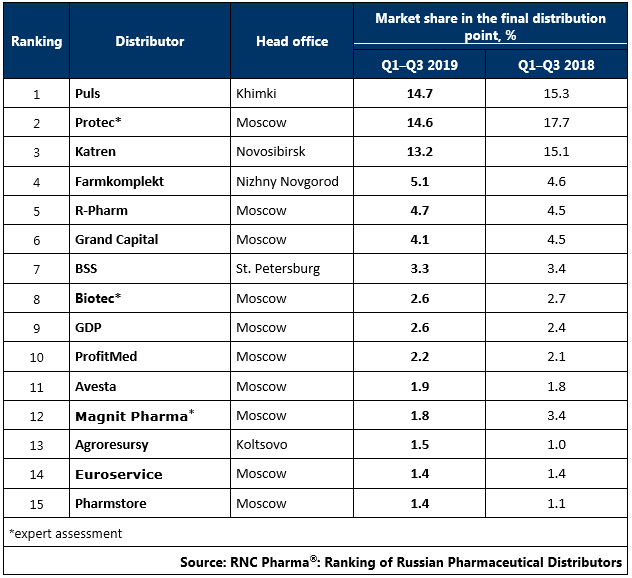

Since the wholesalers are usually very specialized, the Russian pharmaceutical distributors are also developing unevenly. Most of the top 15 distributors are companies working with the retail market. These companies need to have at least double-digit dynamics if they wish to keep last year’s market share, which is not that easy even in the best of times and nearly impossible when the demand is dropping. In an already familiar process this year, the top three wholesalers’ market shares are falling simultaneously. The drop is significant enough to lead to the deconcentration trend in the wholesale trade. This is clearly the result of the client pool optimization strategy, as well as the uneven market development.

So far, this approach may not have been fully justified. Not to mention the not too optimistic macroeconomic indicators, the uncertainty with the introduction of labeling and a heap of regulatory proposals regarding restrictions on the supply chain, the pharmaceutical retail large wholesalers have to act cautious to some extent, with the upcoming cancellation of UTII, and hence the large-scale redistribution in most regional markets.

Tab 1. Top 15 pharmaceutical distributors with the largest market share of direct pharmaceutical drug supply (including preferential and regional supply), in monetary terms (Q1 – Q3 2019)

Рус

Рус