RNC Pharma: Best-Selling Foreign Veterinary Brands Keep Ranking High Thanks to Online Sales

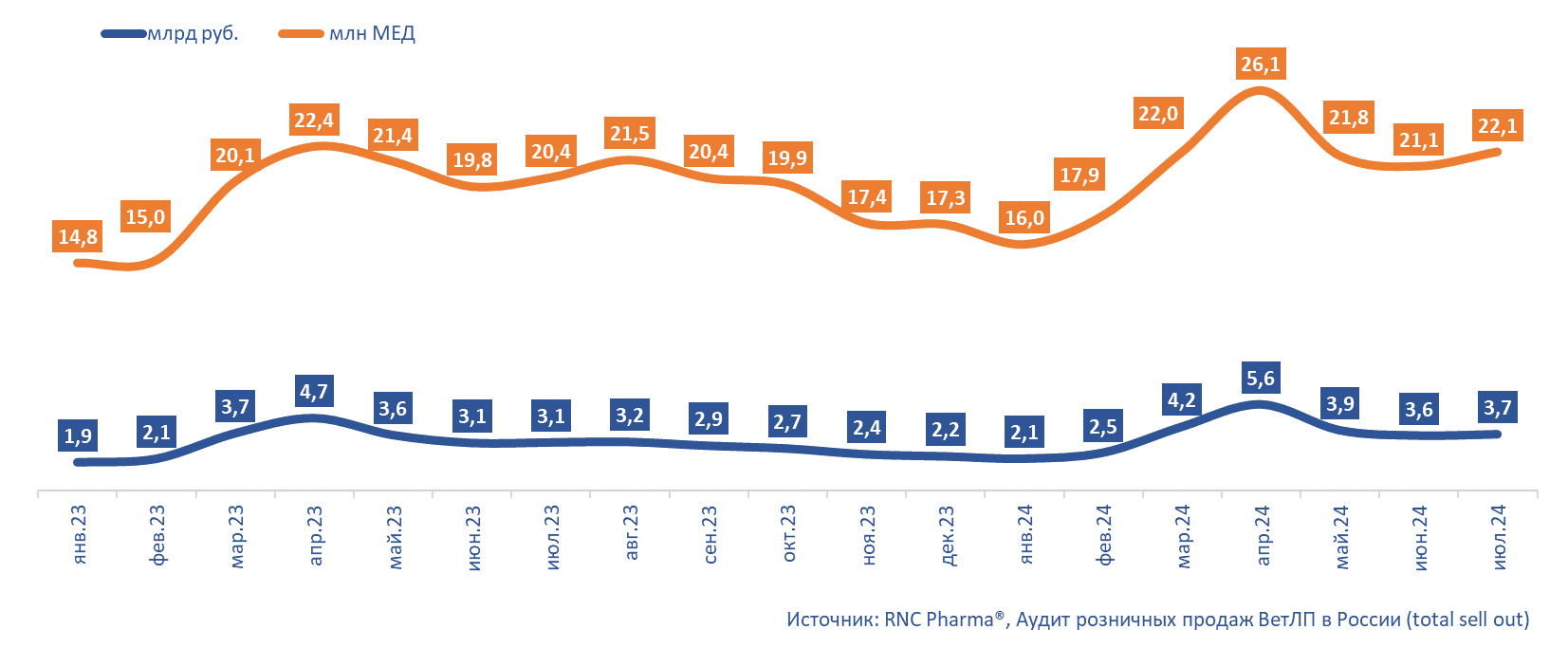

In January–July 2024, over 25.5 billion rubles’ worth of veterinary drugs were sold on the Russian veterinary retail market (retail prices, VAT included), up 14.7% from January–July 2023. In physical terms, it was 147 million minimum dosage units (MDU), up 9.7% from the same period in 2023. E-com contributed to the growth rates the most, since online sales went up 66% and up 37.7% in monetary and physical terms, respectively.

Offline sales increased as well, although just by 5.4% in rubles and by 5.5% in MDUs. Online sales grew the most in early 2024, in particular January, when they doubled against January 2023. In January–July 2024, online sales accounted for 22.1% in monetary terms against 15.2% in January–July 2023. In physical terms, it was 16.3% against 13%.

April 2024 saw an increase in sales, typical to the so-called “high season”, and then the demand for veterinary products started to go down. In July, however, the sales of veterinary drugs grew slightly, by 16.8% and by 8.2% in monetary and physical terms, respectively. The total sales in July were 22.7 million MDUs worth 3.7 billion rubles.

From January to July 2024, 1,778 brands of veterinary drugs were sold on the market, up 26 from January–July 2023. Interestingly, the number of brands went up both in the online and offline segments. However, e-com still grows faster, with 984 brands, up 90 from the same period in 2023.

The insectoacaricide Simparica by Zoetis (USA) remains the market leader. At the same time, its sales in physical terms have been rapidly declining, and in January–July 2024, decreased by 31% from January–July 2023. In monetary terms, however, the sales grew significantly due to the fact that the average price more than doubled against January–July 2023.

Another insectoacaricide, Bravecto by American MSD, ranked second. However, its sales in physical terms fell 55% from January–July 2023. Foreign brands maintain their positions mainly thanks to online sales; for example, the online sales of Bravecto went up 89% in rubles and up 40% in MDUs.

Russian-made drugs are gradually catching up with the foreign brands. In particular, the Inspector antiparasitics and insectoacaricides by Ekoprom ranked third in January–July 2024, growing by 67% in monetary and by 52% in physical terms.

Fig. Monthly growth rates of the Russian veterinary retail market (offline / online) in January 2023–July 2024 (retail prices, VAT included)

*including manufacturing output of foreign companies at owned and contract plants

Рус

Рус