RNC Pharma: Two Russian Veterinary Drug Manufacturers Enter Top 5

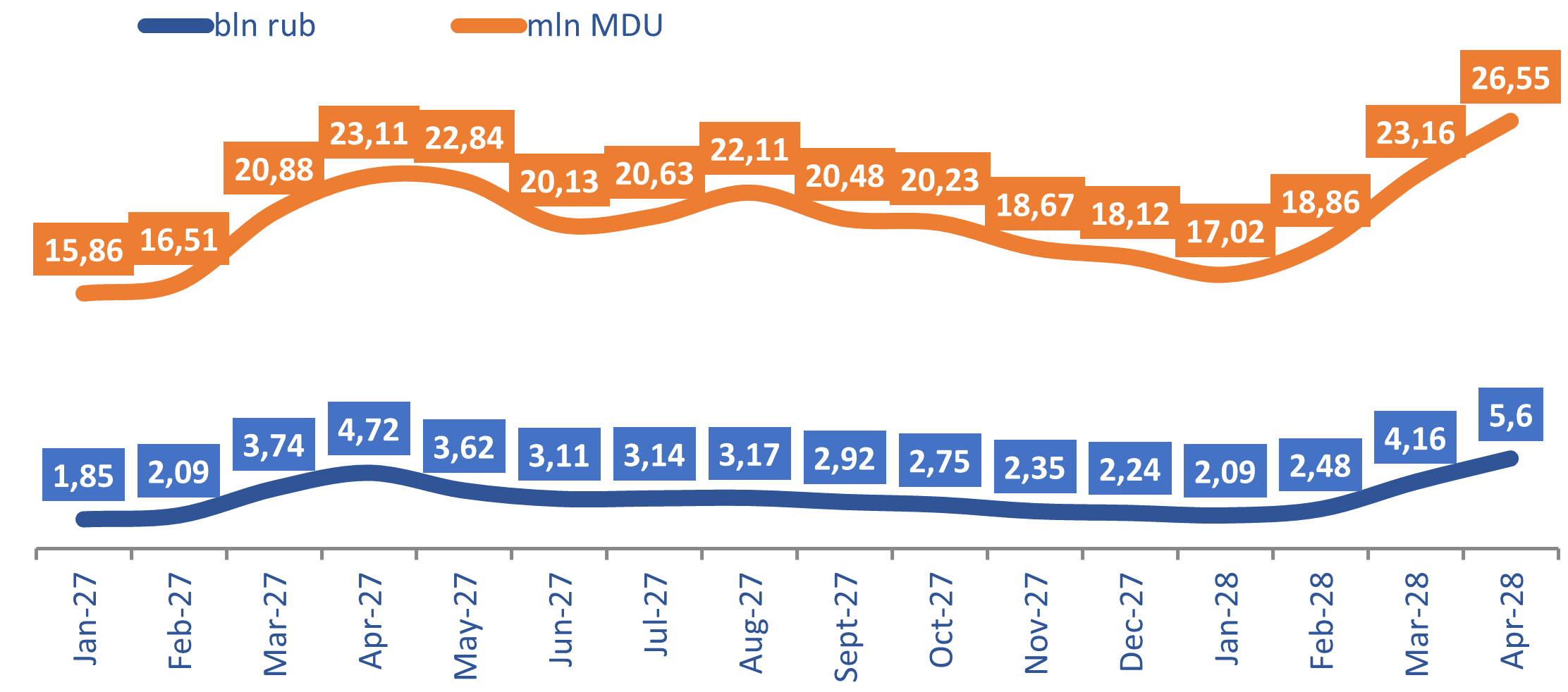

In January–April 2024, 14.3 billion rubles worth of veterinary drugs were sold on the Russian veterinary retail market (retail prices, VAT included), up 15.6% from the same period in 2023. In physical terms, 85.6 million minimum dosage units (MDU) were sold, up 12% from January–April 2023. Online sales contributed to the high growth rates the most—they went up 73.4% in monetary terms and 50.8% in physical terms. The growth rates of the offline channel are only 5.4% and 6.9%.

Online sales accounted for 22.6% of the total sales in rubles in January–April 2024 (against 15.1% in January–April 2023). In physical terms, the share grew from 11.9% in 2023 to 16% in 2024. Due to the so-called “high season”, April saw an increase in the demand for certain groups of veterinary drugs—26.5 million MDUs worth 5.6 billion rubles were sold.

In January–April 2024, products of 1,661 veterinary brands were sold both offline and online. As usual, the number of brands sold online was noticeably smaller—920, although it grew from 830 in January–April 2023. The number of brands sold offline was 1,647, down 18.

American Zoetis accounted for the largest share of the sales—13.7%. Interestingly, in January–April 2023, another American company, MSD, topped the sales. Zoetis is followed by Elanco (USA) with 11.2%. Russian Ekoprom rounds out the top three—the company’s sales went up 69%, to 1.5 billion rubles. Notably, Russian AVZ follows Ekoprom with a 32% increase in sales. As we can see, two Russian companies were among the top five corporations in January–April 2024, while it was only Ekoprom a year ago. Slovenian KRKA also saw high growth rates in rubles—up 77%. The company rounds out the top five corporations, which together account for more than 50% of the sales.

However, two top 10 companies saw a decrease in sales in monetary terms—in particular, American MSD fell to sixth place, with its sales going down 37%. Boehringer Ingelheim suffered a 22% decrease. The companies’ sales dropped in physical terms as well.

Fig. Monthly growth rates of the Russian veterinary retail market (e-com included) in January 2023–April 2024 (retail prices, VAT included)

Рус

Рус