RNC Pharma: First Six Months of 2024 See Implosive Growth in Investment Activity

Russian pharmaceutical companies were very likely to resume investment activity during the first half of 2024, both by attracting investments and concluding various types of transactions, in particular those involving distribution companies or their divisions. Pharmaceutical retail is of primary interest, and the most striking example here is Rigla buying Yuri Gaisinsky’s Nizhegorodskaya Aptechnaya Set (Nizhny Novgorod Pharmacy Chain), a large regional player, known to consumers as Farmani and Aptechestvo. By the standards of the Russian pharmaceutical market, the asset is quite large, with nearly 380 pharmacies worth around 2.2–3.4 billion rubles.

That was the first major purchase since late 2023, when Pharmacy Chain 36.6 became the owner of the Lekopttorg & Rodnik Zdorovya chain. While the purchase may have looked strategically correct but somewhat untimely at that time, it seems mainstream now. On the one hand, all this shows that the pharmaceutical market is becoming more stable, with a positive long-term outlook, including confidence in the return on investment. On the other hand, this highlights the decline in retail profitability, which stimulates consolidation processes. Being part of a pharmacy association does not seem to help to save the situation any more, considering that Nizhegorodskaya Aptechnaya Set belonged to the Iris association. There were other notable transactions, in particular the Neo Pharm chain purchasing Dmitry Rutskoi’s Aptechnye Traditsii in mid-summer.

The current economic cycle stimulates investment activity of wholesale companies’ manufacturing plants as well. For example, R-Pharm recently bought the Baltpharm plant located in the St. Petersburg Special Economic Zone, which allows R-Pharm to finally implement the offset contract won by the company back in early 2023. Another important piece of news is a document that launches the reformation of the system of preferences for Russian players. While full-scale changes will not be visible until next year, we can expect much more attention to the production sector from market participants.

Among other interesting minor news in the industry is the partnership of Magnit Apteka with the Puls distributor. The supermarket chain is establishing a marketplace with a focus on beauty and health products. So far, the project looks rather modest, since the development opportunities are severely limited by the range of products in Magnit offline pharmacies. The company needed an industry partner for development and chose one of the largest Russian pharmaceutical distributors. This partnership shows that Magnit no longer tries to develop its own wholesale division, ditching a competitive strategy in favor of partnerships with the pharmaceutical market leaders.

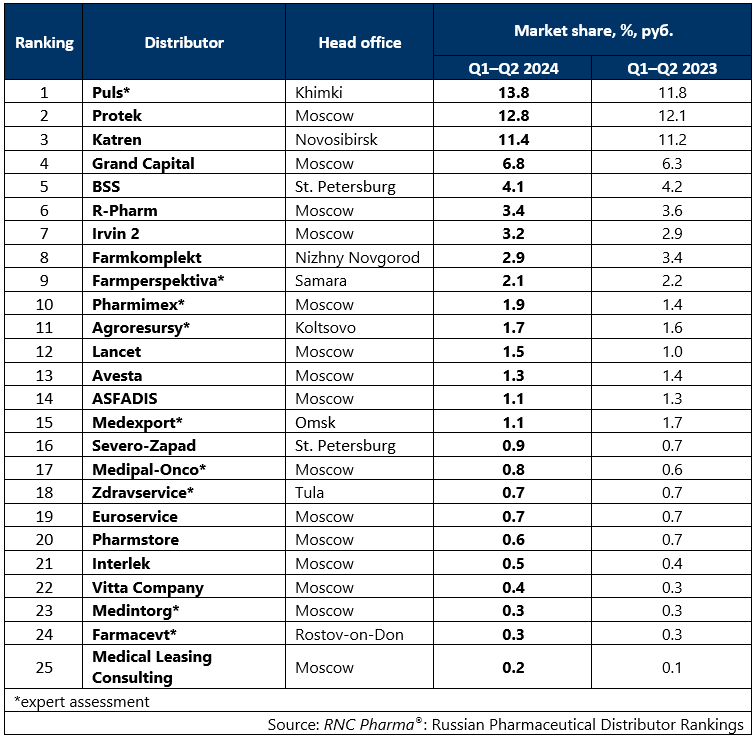

Tab. Top 25 pharmaceutical distributors with the largest market shares of direct pharmaceutical drug supplies (including preferential supplies), in monetary terms, Q1–Q2 2024

Рус

Рус