RNC Pharma: Foreign Pharma Companies That Have Localized Production in Russia Contribute to Growth Rates in January–July 2024

In January–July 2024, veterinary drugs on the Russian retail market (e-com included) went up in price 31.8% from January–July 2023. The price index in 2023 was 26.6%. The fastest price growth rates were seen in early 2023, and inflation surged in June–August 2023 (Fig. 1). By the end of the year, the prices had stabilized. An upward trend began in early 2024, peaking at 44.9% in March 2024 before going down again to 24.2% in July 2024.

Fig. 1. Inflation rates in the veterinary retail market in January 2023–July 2024

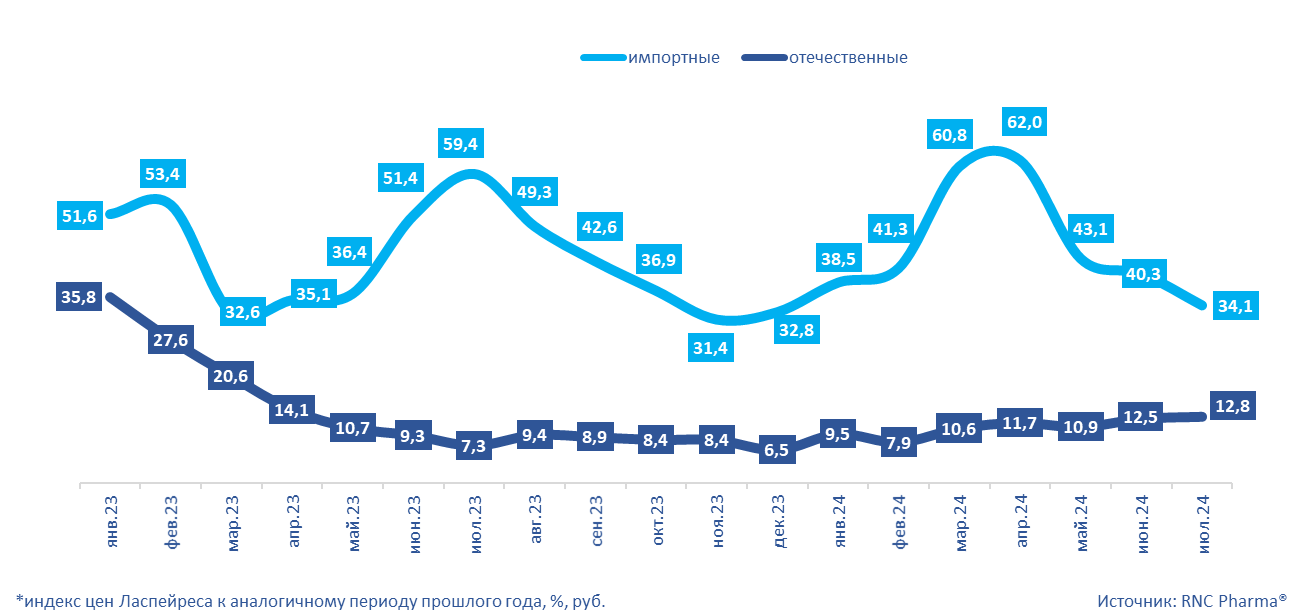

The price indices for imported and Russian-made drugs differed significantly (Fig. 2). The prices for imported goods kept rising and falling, while inflation for Russian-made products decreased and stabilized at around 10% in the second half of 2023. This trend continued in January–June 2024. The inflation rate hit an all-time-low, 62%, in April 2024. In July 2024, however, the inflation rate dropped to 34.1%. In January–July 2024, the prices for imported veterinary drugs went up 46.6%.

The inflation rate for Russian-made drugs peaked in January 2023 at 35.8%, before starting to go down and finally reaching a twelve-month-high, 6.5%, in December 2023. In January 2024, however, the prices started to grow (9.5%). The inflation rates ranged from 7.9% in February 2024 to 12.8% in July 2024. In January–July 2024, the prices for Russian-made veterinary drugs went up 9.1%.

Fig. 2. Inflation rates* in the veterinary retail market in January 2023–July 2024, % (imported / Russian-made)

The price indices differed greatly from segment to segment in 2023 (Fig. 3). E-com is more affected by inflation, which explains why the online prices went up 45% against 23% in the offline segment. The inflation rate in the offline market went up in January–March 2024, peaking at 40.4% in March before dropping to 22.6% in July 2024. E-com saw a similar trend: the inflation rate started to go down in April 2024, before hitting a seven-month-low, 23.2%, in July 2024. In January–July 2024, the offline prices grew by 29.4% against 43.1% in the online channel.

Fig. 3. Inflation rates* in the veterinary retail market in January 2023–July 2024, % (online / offline)

*including manufacturing output of foreign companies at owned and contract plants

Рус

Рус