Import of Veterinary Drugs and Feed Supplements to Russia in 2021

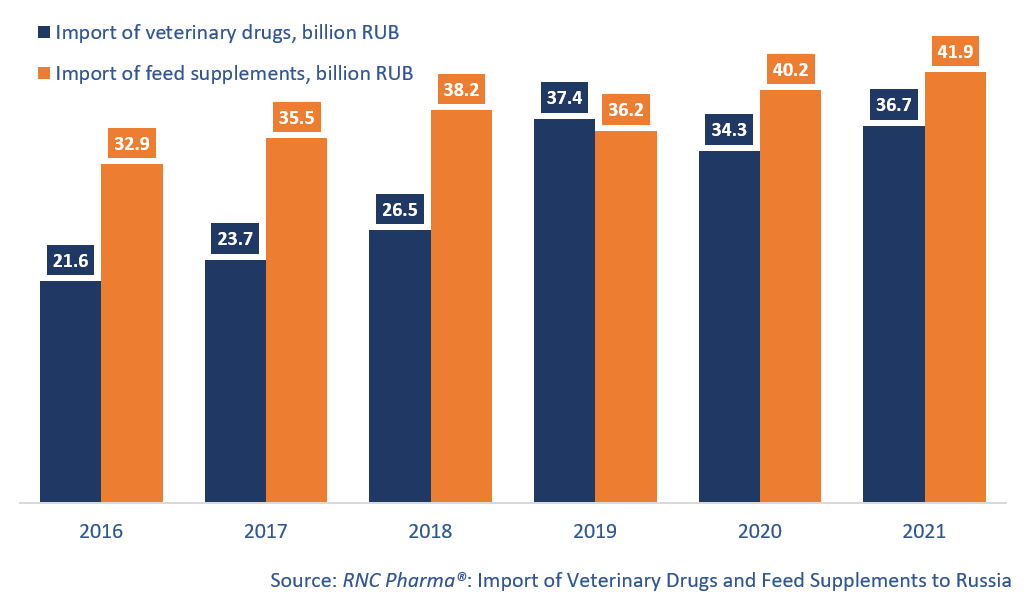

In 2021, Russia imported RUB 36.7 billion worth of veterinary drugs (customs clearance and VAT included), up 7.2% from 2020, hardly comparable to that in 2019. As for feed supplements, the import volume was RUB 41.9 billion, and the growth rate was 4.3%.

In physical terms, the growth rate of veterinary drug import was 2.5%, with a volume of 31.8 million packages, or 115.5 million minimum dosage units (MDU). Due to the change in the format of retail packaging, the growth rates in MDUs were several times as high as those in packages—10.3%. The growth rate of feed supplement import was –20.8% (in tons), with a volume of 143.9 tons, a historical low in 12 years.

The growth rates also depended on the animal type the imported product was intended for. The import of veterinary drugs for pets increased by 34.1% in monetary terms, while that for livestock animals remained on the same level as in 2020. As for feed supplements, the import for pets and for livestock grew by 15.6% and 3.4%, respectively. At the same time, the import for livestock was naturally larger than that for pets, accounting for 74% of the import volume of veterinary drugs and for 91% of feed supplements.

Russia imported veterinary drugs from 107 manufacturers in 2021. Czech Contipro had the highest growth rates, having increasing its imports 7.9 times compared to 2020. The company imported only Bonharen, a drug for the treatment of arthrosis and arthritis in horses and small pets. Contipro is followed by Industria Italiana Integratori (imports grew 6 times), which imported three drugs for livestock to Russia in 2021, with antibacterial Doxipan contributing to the growth rates the most. Both companies are outside the top 20, however. As for the top companies, Pucheng Chia Tai Biochemistry is worth mentioning, having increased its imports 2.6 times. The company imported two antibacterial drugs for livestock animals.

245 manufacturing companies imported feed supplements to Russia in 2021. German ZMC Europe had the best growth rates among to top 20 companies (imports increased 2.3 times in monetary terms). The company imported three drugs, with Vitamin E 50% Feed Grade contributing to the growth rates the most. Austrian Schaumann Group’s imports grew by 78%. It imported products of 14 brand names, but its energy drink Rindavit and metabolism supplement Tirsana BSK contributed to the growth rates the most.

Growth rates of the import of veterinary drugs and feed supplements to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (2016–2021)

Рус

Рус