Pharmaceutical Drug Import to Russia (November 2022)

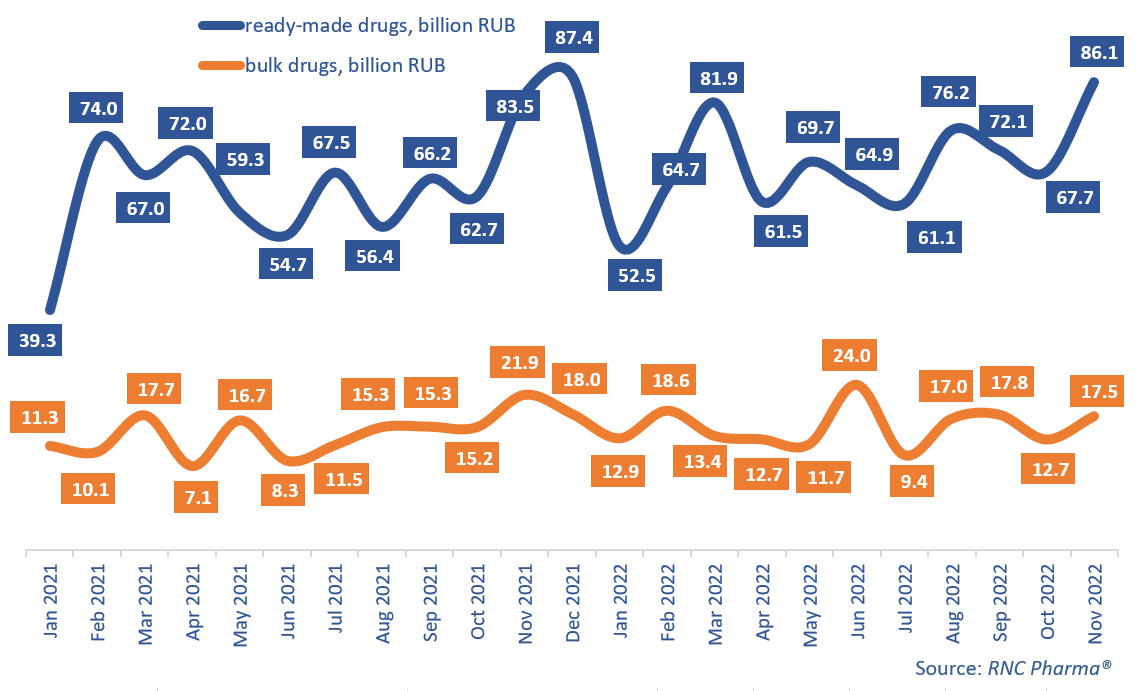

In January–November 2022, Russia imported 758.5 billion rubles’ worth of ready-made pharmaceutical drugs (customs clearance and VAT included), up 8% from the same period in 2021. As for bulk drugs, the import was 167.9 billion rubles, up 11.6%. In physical terms, the import of both groups is unlikely to start growing again—ready-made drugs went down 8.8%, with 1.51 billion packages imported, and bulk drugs went down 28.6%, with 1.38 billion minimum dosage units (MDU).

While not the worst this year, the November results were modest compared to those in September–October. Russia imported 86.1 billion rubles’ worth of ready-made drugs, up 3% from November 2021, or 155 million packages, down 8%. As for bulk drugs, 17.5 billion rubles’ worth of drugs was imported, down 20.2% in monetary terms. In physical terms, the import was up 4%, with 97.6 million MDUs, which is much lower than back in October 2022, when the growth rate was as high as 57%.

The number of companies importing ready-made drugs to Russia in January–November 2022 not only did not decrease, but even seemed to be growing—from 291 companies in January–November 2021 to 295 in 2022. Adienne (Italy) increased its imports almost 90 times against January–November 2021, while importing only one product, the anticancer drug Tepadina. French Orphelia Pharma came second with a 15.7 times’ increase; in January–November 2022, it was importing antiepileptic Kigabeq. The growing demand for the drug, which is not registered in Russia, can be explained by the fact that it is now used as an alternative to Sabril by French Sanofi, which has been experiencing difficulties with the production and import of vigabatrin since July 2022. Sarepta Therapeutics (USA) rounds out the top three—its imports grew 15.2 times against January–November 2021. The company imported three drugs for Duchenne muscular dystrophy, with Exondys 51 contributing to the growth rates the most.

As for bulk drugs, the number of importers is still 95, although the list has changed over the year. In terms of growth rates, Novo Nordisk (Denmark) increased its imports 2.4 times against January–November 2021. It imported four drugs, and the insulin degludec Tresiba, packaged at the company’s own facilities in Kaluga, contributed to the growth rates the most. Imports by Gilead Sciences grew 85% from January–November 2021—eight of their products at once are packaged in Russia. Antivirals Epclusa and Biktarvy helped the company’s growth rates the most.

Growth rates of pharmaceutical imports to Russia (EEU countries excluded), free circulation prices, customs clearance and VAT included, RUB (January 2021–November 2022)

Рус

Рус