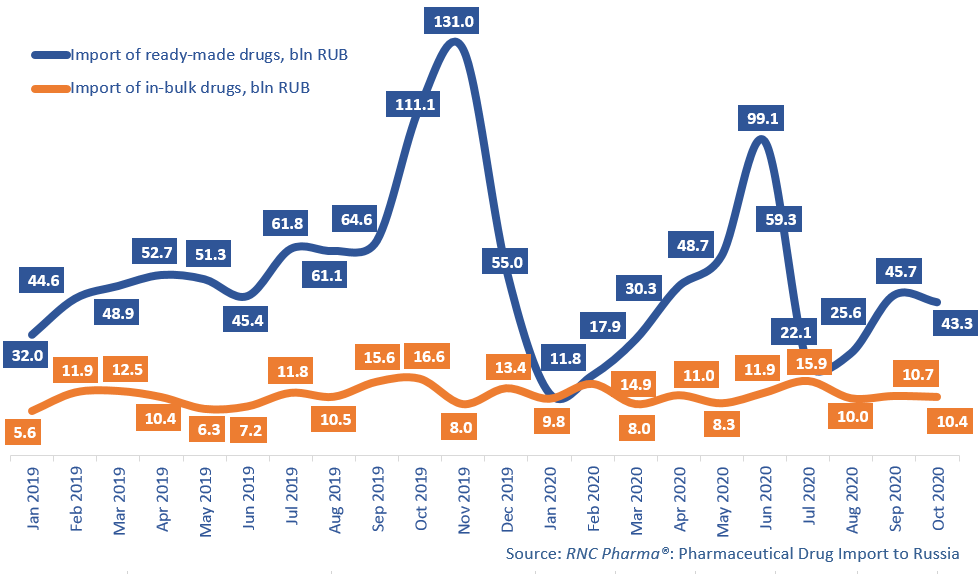

Pharmaceutical Drug Import to Russia (October 2020)

Between January and October 2020, Russia imported RUB 404 bln worth of ready-made pharmaceutical drugs (customs clearance and VAT included), which is in monetary terms (rubles) 29.6% lower than in 2019. That is clearly the high base effect, since back in October 2019 the importers were hard at work, preparing for the launch of the labeling system by actively stocking up the warehouses; the import volumes were 2-3 times higher than usual. The growth rates of the in-bulk import are still positive, although only +2.2%, with the import volume of RUB 110.8 bln.

Despite the significantly varying growth rates in monetary terms, the rate in physical terms is negative for both groups. The import volume of ready-made drugs amounts to 0.97 bln units, which is 43% lower than in 2019. If calculated in minimum dosage units (MDU), the growth rate is a little higher (-39%), with the import volume of 19.3 bln MDUs. The import of in-bulk drugs has dropped by 35%; the import volume amounts to 1.9 bln MDUs.

The October results did not deviate from the current trends, but we should again take into account the vigorous activity of the importers in October 2019. In October 2020, Russia imported RUB 43.3 bln worth of ready-made drugs (-61%), or 101 mln units (-68%). The growth rate of the in-bulk import was also negative, albeit slightly higher.

Roche has the highest import growth rate in October 2020 among the top 25 largest manufacturers of ready-made drugs. The company’s imports have grown by 6.7 times in monetary terms; among the 13 imported products, Tecentriq, Cotellic and Herceptin accounted for the biggest import volumes. BioMarin Pharmaceutical also has high growth rate (+67% in monetary terms); drug for cystic fibrosis Naglazim contributed to the growth rate the most with the import volume of 5,000 units (RUB 481 mln). AstraZeneca comes third with the growth rate of +33% in monetary terms. In October 2020, the company imported 2,000 units (RUB 573 mln) of antitumor drug Linparza.

As for the importers of in-bulk drugs, AbbVie has the best growth rate in the top 25 (imports have increased by 44.5 times in monetary terms). The company was importing 4 products, among which Humira and Viekira Pak, packaged at the facilities of Ortat (R-Pharm group), contributed to the growth rate the most. AbbVie is followed by Octapharma (imports grown by 36 times), which was importing only solution for infusion Albumin, packaged at Skopinpharm (Pharmimex group).

Growth rates of import of pharmaceuticals to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT, RUB (January 2019 – October 2020)

Рус

Рус