Import of Veterinary Drugs and Feed Supplements to Russia (April 2022)

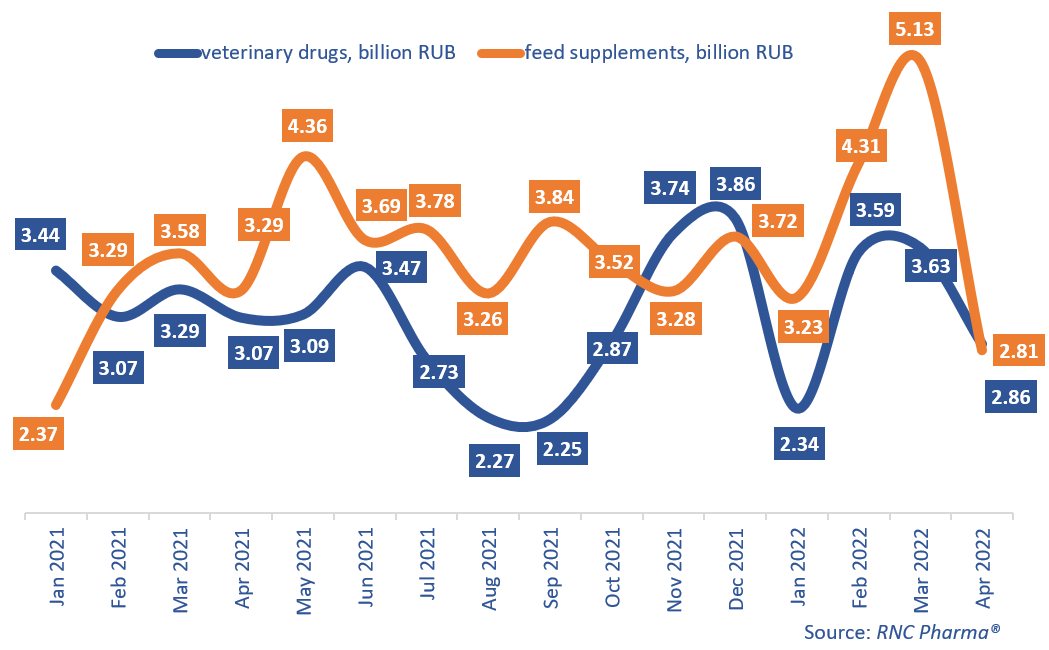

In January–April 2022, Russia imported 12.4 billion rubles’ worth of veterinary drugs (customs clearance and VAT included), down 3.6% from the same period in 2021. As for feed supplements, the import volume was 15.5 billion rubles, up 23.4% from January–April 2021.

In physical terms, the growth rates are negative for both categories. The import volume was 9.4 million packages of veterinary drugs, down 5.9%, and 2.7 million packages of feed supplements, down 2.2%, or 44.4 tons (down 0.7%). While the import of both veterinary drugs and feed supplements in monetary terms grew in February and March, the growth rates in April 2022 went down harshly: –6.9% for veterinary drugs and –14.6% for feed supplements. In physical terms, however, the growth rates were different: +14% for veterinary drugs and –34% for feed supplements, which is understandable, given that the total tonnage of imported veterinary drugs was almost 10 times lower than that of feed supplements. The latter are imported mainly by sea, and container transportation by sea was one of the first logistics services to suffer due to the sanctions.

Importing countries also continued to change in April 2022; in particular, imports of veterinary drugs from Belgium, Austria, France and Germany plummeted. Imports from China (14.6 times in packages), Slovenia (4.8 times) and Switzerland (2.6 times) grew significantly. As for feed supplements, imports from Germany, Belgium and Malaysia sharply decreased, while imports from Turkey increased 8 times (in tons) against April 2021, as well as from China (2.9 times), and from Hungary (20 times).

Spanish Laboratorios Maymó had the best growth rates in January–April 2022 among the top 20 manufacturing companies of veterinary drugs. The company’s imports increased 22.8 times against January–April 2021, with antibacterials for livestock animals Doxigran and Enrogran contributing to the growth rates the most. Laboratorios Maymó is followed by another Spanish company, Biokorm International, which increased its imports 14.6 times against January–April 2021 thanks to antibiotics, in particular Amoxivet. Chinese Zhejiang Dayang Biotech Group rounds up the top three, having increased its imports 7.9 times. Its antibacterial Enduro contributed to the company’s growth rates the most.

As for feed supplements, Dutch Orffa Additives (imports grew 5 times) and Chinese Sunwin Biotech (4.1 times) were the best in terms of growth rates. In the case of Orffa Additives, imports of the Excential products and Orffa Vitamins helped the growth rates. The only product Sunwin Biotech imported was Betaine Hydrochloride.

Growth rates of the import of veterinary drugs and feed supplements to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (January 2021–April 2022)

Рус

Рус