Pharmaceutical Drug Production in Russia (First Half of 2020)

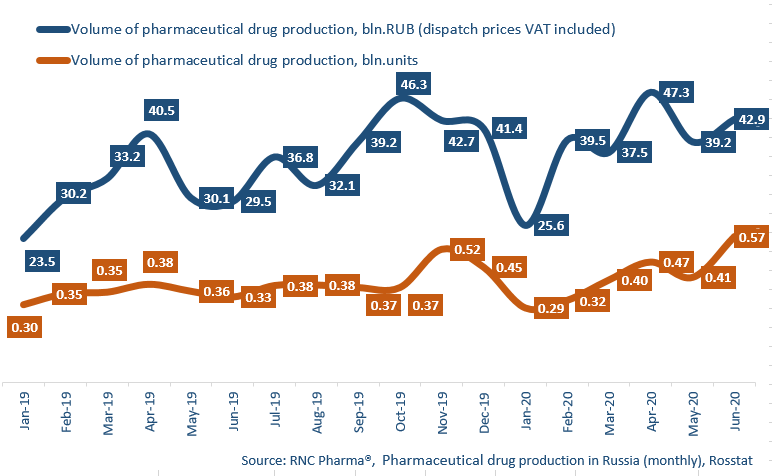

Between January and June 2020, Russia manufactured 232 bln RUB worth of pharmaceutical drugs (manufacturers’ dispatch prices, VAT included), which is in monetary terms (rubles) 24% higher than in 2019. The dynamics in physical terms (units) are +18.3%, with the manufacture volume of 2.45 bln units. If calculated in minimum dosage units (MDU), Russia manufactured 42.7 bln MDUs, with the dynamics of +21.2%.

The dynamics in monetary terms in June 2020 are +45.7%, which is impressive, but not record-worthy (like +47.5% in November 2019 or +61% in April 2019). However, the dynamics in physical terms are record-high, +69.5% (the highest in 10 years). The second high dynamics were registered back in November 2019, +36%. Both in November 2019 and in June 2020, Russian manufacturers were stocking up the warehouses to get ready for the launch of the labeling system. The dynamics will obviously drop as early as by the end of July 2020.

The dynamics of the manufacture of OTC drugs in physical terms are +12.7%, and +26% for Rx drugs.

Mosfarm has the best dynamics among the top 50 manufacturers of Rx drugs (manufacture volume has grown by 18.4 times in physical terms). Mosfarm is followed by Usolpharm (manufacture grown by 13.8 times), which was manufacturing seven ready-made drugs in the first half of 2020 (three drugs in 2019). The manufacture of Phenibut has the highest dynamics (grown by 14 times). Biofarmkombinat from the Ryazan Region also has good dynamics (manufacture grown by 10 times), while manufacturing trivial Ethyl Alcohol and Medical Antiseptic Solution. It is clear that the hype during the coronavirus epidemic was the key factor here.

Firn M still has the highest dynamics in physical terms among the top 50 manufacturers of OTC drugs. The company’s manufacture has increased by 144 times, with Grippferon contributing to the dynamics the most. Usolpharm and Slavyanskaya Apteka are also worth mentioning. Corvalol, Motherwort Extract, Validol, and Trekrezolid (alternative to Solopharm’s Trekrezan) contributed to the dynamics of Usolpharm, and Naphthyzin was the most manufactured drug by Slavyanskaya Apteka.

Dynamics of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (January 2019 – June 2020)

Рус

Рус