Pharmaceutical Drug Production in Russia (February 2021)

Between January and February 2021, Russian manufacturers produced RUB 101.4 bln worth of pharmaceutical drugs (manufacturer’s prices, VAT included), which is in monetary terms (rubles) 61% higher than in 2020. The growth rate in physical terms (units) is a bit lower, +16%, with the production volume of 700 mln units. If calculated in minimum dosage units (MDU), the growth rate is only +2.4% and the production volume is 11.9 bln MDUs.

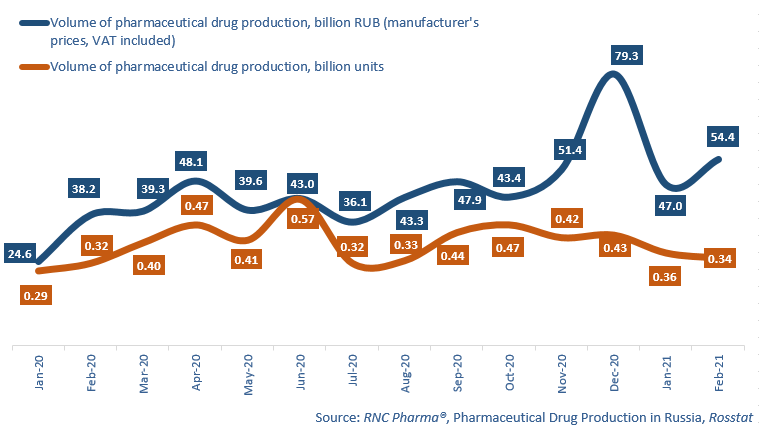

The growth rates in both monetary and physical terms have been rather high since the beginning of the year. Still, the growth rates in February turned out to be much lower than those in January, despite the traditionally low activity in January due to the long New Year and Christmas holidays. The growth rates in February were +42.5% in monetary and +7.9% in physical terms, while in January they were +91% and +25.4%.

Even based on the approximate figures, serious change in the structure of the manufactured products drugs is obvious, due to a number of reasons, including the shift towards products of the upper price segment. As for the production of the main drugs groups, the growth rates in physical terms are also significantly different: +21% for the production of Rx drugs and +12% for OTC drugs. However, the production volume of OTC drugs is still higher; between January and February 2021, OTC drugs accounted for 53% of the production volume in physical terms.

231 companies were manufacturing prescription drugs in January–February 2021. Alium produced the largest volumes in physical terms, with the growth rates of +13%. The production of antibacterials contributed to the growth rates the most, in particular, Sultasin (increased by 13 times), Azithromycin (12 times), and Levofloxacin (8 times). Tula Pharmaceutical Plant has the highest growth rates in physical terms – the company’s production volume has increased by more than 14 times. The production of powder for oral solution Magnesii Sulfas contributed to the growth rates the most, having increased by 56 times.

120 companies were producing OTC drugs. Pharmstandard demonstrates the largest production volume, as well as more than two-fold growth rates. Arbidol is still the company’s most manufactured drug; the production has grown by 3.7 times, which is more likely a low base effect, since the first months of last year were relatively calm, and the hype and a sharp increase in production took place between March and April. Valenta has the highest growth rates among the top 10 companies, with a 54 times’ increase. Ingavirin and Grammidin contributed to the growth rates the most.

Volumes of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (January 2020 – February 2021)

Рус

Рус