Veterinary Vaccine Import to Russia in 2022

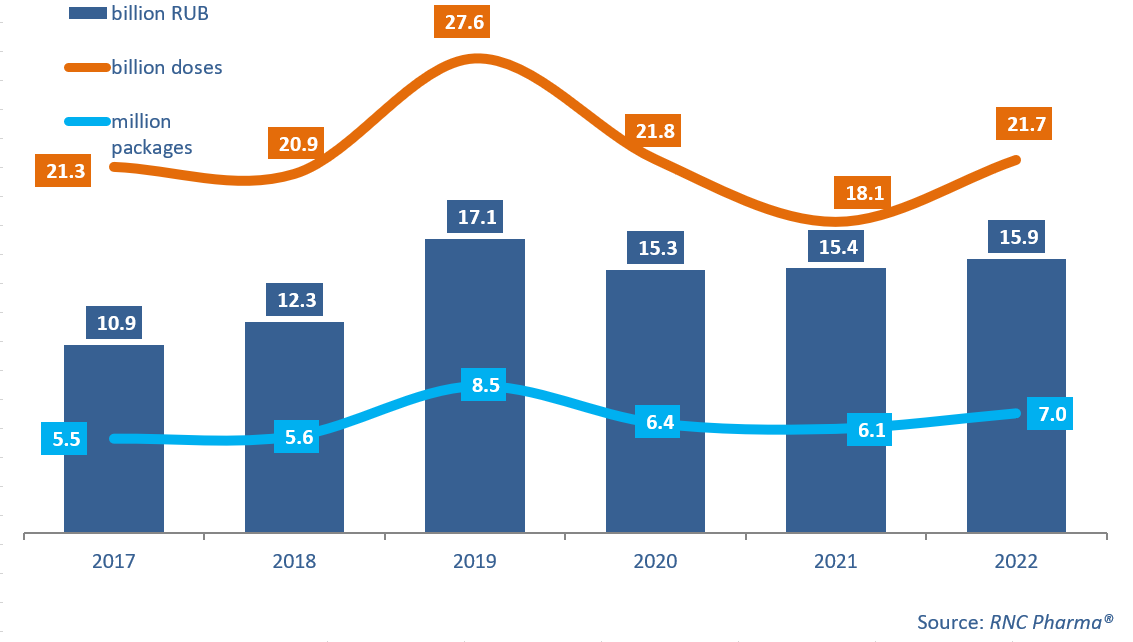

In 2022, Russia imported 15.9 billion rubles’ worth of veterinary vaccines (EEU imports excluded; customs clearance and VAT included), up 3.4% from 2021)—practically the same as in the past three years. In physical terms, 7 million packages were imported, up 14.9% from 2021. If calculated in doses, the import was 21.7 billion, up 19.8% from 2021.

Even with the objectively more difficult market conditions in 2022, the market managed to recover after the low results of 2021. While the results of 2019 may seem unattainable, they were associated with regulatory changes in the industry, not high demand. The structure of vaccine imports differed from type to type in 2022—imports of live vaccines had the best growth rates in monetary terms (up 10.8%), while imports of inactivated vaccines fell 2.7%. As a result, imports of both groups became more or less the same in volume, with the former slightly above the latter. Imports of combined vaccines grew by only 0.2%, accounting for less than 7%.

Imports depended as much on the types of animals. In particular, imports of vaccines for livestock increased 7.3% from 2021 in rubles. The number of vaccine brands for farm animals fell by 11—to 93 vaccines from 17 companies. Erypesten by Bioveta (Czech Republic), a drug for the prevention of erysipelas and classical swine fever, showed impressive growth rates in monetary terms—its imports went up 3.8 times against 2021. Imports of Innovax by MSD (USA), a drug for the prevention of Marek’s, Newcastle, and Gumboro diseases in birds, grew 3.4 times against 2021.

As for vaccines for pets, imports fell by as much as 31.6%—a negative trend for the third year in a row. The numbers of brands remained practically the same—11. The drop was almost entirely due to problems with the import of the Nobivac products by MSD—its imports went down 75% in monetary terms. Interestingly, while the products were imported to Russia on a monthly basis in 2021, March 2022 saw no imports at all, and minimum amounts were imported in June, July, and October. Bioveta products had the best growth rates, in particular Biofel (imports grew 70 times against 2021) and Biocan (2,059 times), technically replacing certain products of the Nobivac line for cats and dogs, which could not be imported due to difficulties.

Growth rates of the imports of foreign veterinary vaccines to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (2017–2022)

Рус

Рус