RNC Pharma: Average Retail Price for Automatic Blood Pressure Monitors Drops 18% in 2023

In 2023, around 6.0 million of blood pressure monitors worth 11.9 billion rubles (retail prices, VAT included) were sold on the offline and online retail markets in Russia. The sales went up 29% in physical and up 10% in monetary terms. At the same time, the average price dropped—it was 1,970 rubles in 2023 against 2,310 in 2022. While the prices for this category of medical equipment in 2023 dropped 5% from 2022, the inflation rate in Q1 2024 was 2.7% against Q1 2023.

Automatic blood pressure monitors accounted for 90.5% of the sales in monetary and for 86% of the sales in physical terms. Manual blood pressure monitors were the second most popular type, accounting for more than 8% of the sales in rubles and almost 15% in units. Semi-automatic devices remain the least popular category; the demand has been declining for several years in a row—this type of blood pressure monitors accounted for about 2% of the sales in 2022, then 1.3% in 2023, before dropping to 1.1% in Q1 2024.

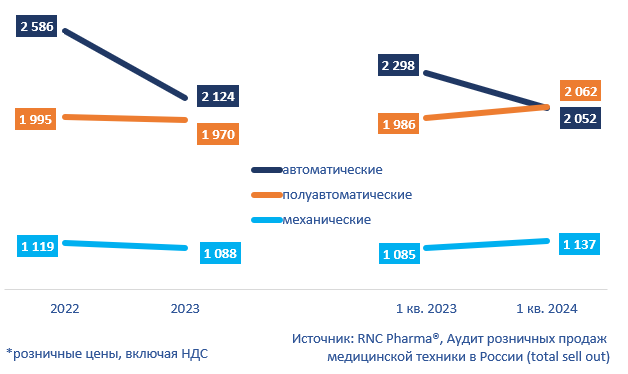

Interestingly, the price for automatic blood pressure monitors followed a trend down, nearly reaching the price for semi-automatic devices. The average price for automatic blood pressure monitors went down 18%, to 2,100 rubles, while that for semi-automatic devices was around 2,000. In January–March 2024, the average prices for both automatic and semi-automatic devices were practically the same, 2,100 rubles, with a difference of less than 10 rubles. While the price for semi-automatic blood pressure monitors grew 4% from Q1 2023, that for automatic devices kept falling—it went down 11%. At the same time, the average price for manual devices went up 5%, to 1,100 rubles.

The average price for unbranded devices fell by 30% from 2022, to 853 rubles. However, even the top devices went down in price. In particular, the average price for products of the most popular brand, A&D, dropped 9.6%, to 2,300 rubles, and Omron devices fell in price 3.7%, to 3,100 rubles.

The offline sales of blood pressure monitors went down 1.7% in monetary terms, but rose 2.3% in physical terms. They accounted for around 75% of the total sales in monetary terms, down 9% from 2022. The online sales, however, went up by as much as 74% in monetary terms. In physical terms, the online sales increased 2.4 times against 2022.

Japanese blood pressure monitors remain the most popular devices in Russia, accounting for more than 59% of the sales in monetary terms, although it was 63% back in 2022. Swiss devices accounted for less than 20% of the sales; the share went down from 2022 as well. Yet, only Chinese, Russian and unbranded products did not see their shares drop in 2023. The share of Chinese manufacturers went up to 3.4% in 2023, and then to nearly 4% in Q1 2024. Russian companies accounted for only 0.3% of the sales in rubles and for 0.7% in physical terms in 2023. Still, the sales of Russian devices went up 74% in monetary terms and doubled in physical terms.

In 2023, the sales of Japanese A&D exceeded those of another Japanese company, Omron, going up 5% in monetary and up 16% in physical terms. The sales of Omron products rose 3% in rubles and 6% in units. Swiss B.Well rounds out the top three—its sales went up 0.2% in rubles and 0.8% in units.

Fig. Growth rates of prices for various types of blood pressure monitors on the Russian retail market (e-com included), RUB

Рус

Рус