Import of Veterinary Drugs and Feed Supplements to Russia (July 2022)

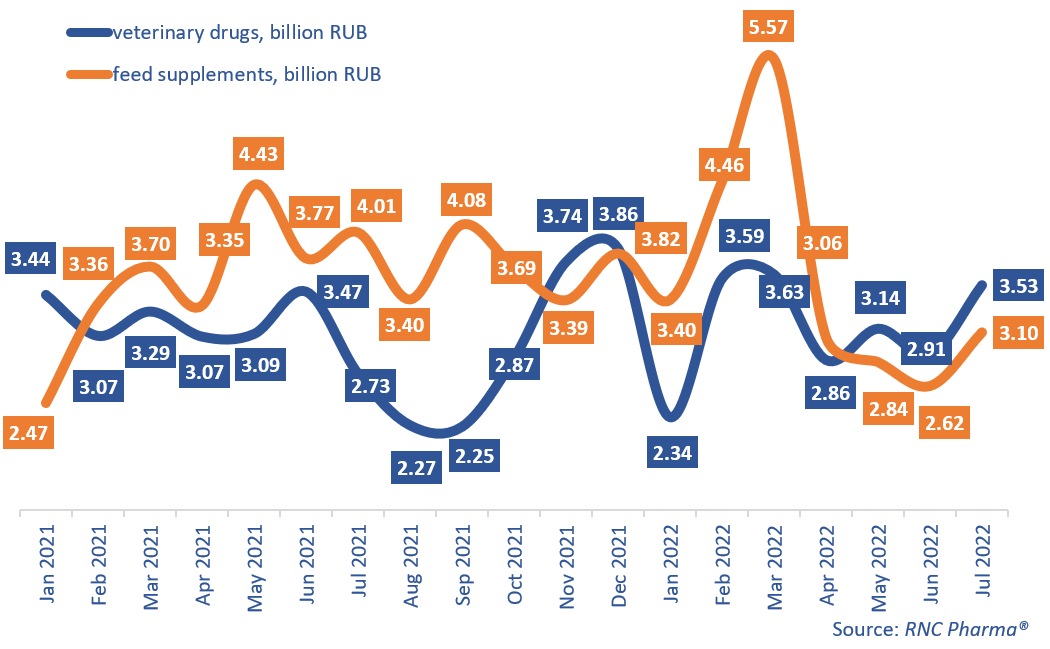

The growth rates of veterinary imports to Russia in monetary terms kept falling in January–July 2022. Russia imported 22 billion rubles’ worth of veterinary drugs (customs clearance and VAT included), down 0.8% from January–July 2021, and 25 billion rubles’ worth of feed supplements, down 0.1% from January–July 2021. In physical terms, the growth rate of the import of veterinary drugs was 4.7%, with 19.1 million packages imported. As for feed supplements, the import volume was 80,300 tons, down 16% from January–July 2021. In July 2022, the imports, once again, grew and fell at the same time. The growth rates of the veterinary drug import were 29% in rubles and 45% in packages. The import of feed supplements, however, was down in both monetary (–23%) and physical terms (–19%). Notably, the import of both product groups in July 2022 significantly increased compared to June 2022.

Products for livestock animals accounted for the largest volume in the total import of veterinary products—74.7% for veterinary drugs and 82.5% for feed supplements. At the same time, the import of both drugs and feed supplements for livestock dropped in monetary terms, while the import of products for pets grew. The import of veterinary drugs for pets was up 7.2% from January–July 2021, and the import of feed supplements skyrocketed, increasing by as much as 81%.

Laboratorios Maymo (Spain) had the best growth rates in monetary terms among the top 20 importers of veterinary drugs in January–July 2022—its imports grew 20.6 times against January–July 2021, setting a record for the analyzed period. The company imported six different brands, with two antibacterials for livestock, Doxigran and Enrogran, contributing to the growth rates the most. As for drugs for pets, Euracon Pharma (Germany) had the best result, increasing its imports 3 times against January–July 2021. The import of its anthelmintic Caniquantel contributed to the company’s growth rates the most. However, the company is outside the top 20 in terms of import volume.

Ningxia Unisplendour (China) had the highest growth rates among the top importers of feed supplements—its imports went up 72.5 times against January–July 2021, with DL-Methionine contributing to the growth rates. TRM Thoroughbred Remedies (Ireland) had the best results among the manufacturers of feed supplements for pets, increasing its imports 4.6 times against January–July 2021. The company imported two products, with Stride, a chondroprotector for dogs, helping the growth rates the most.

Growth rates of the import of veterinary drugs and feed supplements to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (January 2021–July 2022)

Рус

Рус