Import of Veterinary Drugs and Feed Supplements to Russia (December 2022)

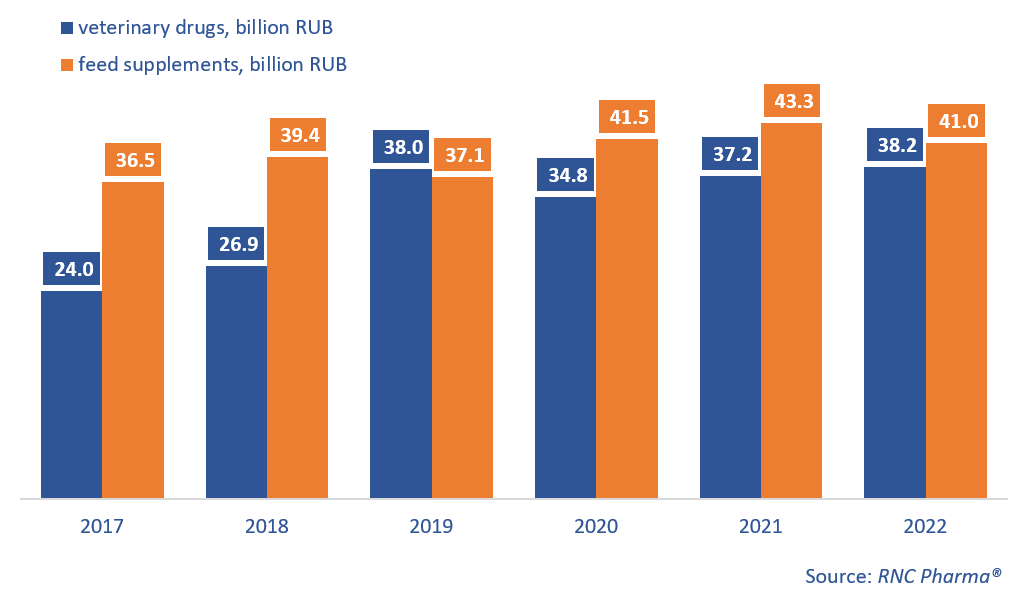

In 2022, Russia imported 38.2 billion rubles’ worth of veterinary drugs (customs clearance and VAT included; imports from EEU countries excluded), up only 2.8% from 2021, although the import volume was record-worthy. In physical terms, Russia imported around 34.1 million packages, up 7.1% from 2021. As for feed supplements, imports went down 5.2%, with 41 billion rubles’ worth of products. In physical terms, Russia imported 149,700 tons, down 7.7% from 2021.

Growth rates in December 2022 were rather different from the average growth rates in 2022—the veterinary market showed a very clear desire to stock up before the New Year holidays. Imports of veterinary drugs increased by 9.2% in rubles (4.2 billion rubles imported) and by 28.7% in packages (3.4 million packages). As for feed supplements, Russia imported 4 billion rubles’ worth of products, up 6.4% from December 2021, or 15,800 tons, up 40%.

Imports of veterinary drugs for farm animals contributed to the growth rates the most—imports went up 6.9%, while imports of drugs for pets decreased 9.1%. The number of manufacturing countries was 39, down 4 from 2021. The number of manufacturers went down as well—from 107 in 2021 to 96 in 2022. Zanderhof (Netherlands) had the best growth rates—its imports grew 16 times in monetary terms against 2021. The company imported only products for livestock, and its antibacterials Salifors, Avilamax, and Enramix contributed to the growth rates the most. Zanderhof is followed by Zoovet Productos (Argentina)—the company’s imports of drugs for livestock animals increased 13.1 times against 2021. Its combined antibiotics with NSAIDs, Cefafur and Ziflor Fenac, contributed to the growth rates the most.

As for feed supplements, imports for pets helped the growth rates here, having went up 43.5% in rubles, while imports for farm animals fell 11%. The number of manufacturing countries fell from 43 in 2021 to 35 in 2022, while the number of manufacturing companies went down by as many as 38, to 217. Hebei Feed Science (China) had the highest growth rates—its imports of Choline Chloride for pets grew 15.4 times against 2021. Hylen (China) comes second with a 13.5 times’ increase. In 2022, it imported feed supplements for livestock, in particular Betaine Hydrochloride and Choline Chloride.

Growth rates of the import of veterinary drugs and feed supplements to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (2017–2022)

Рус

Рус