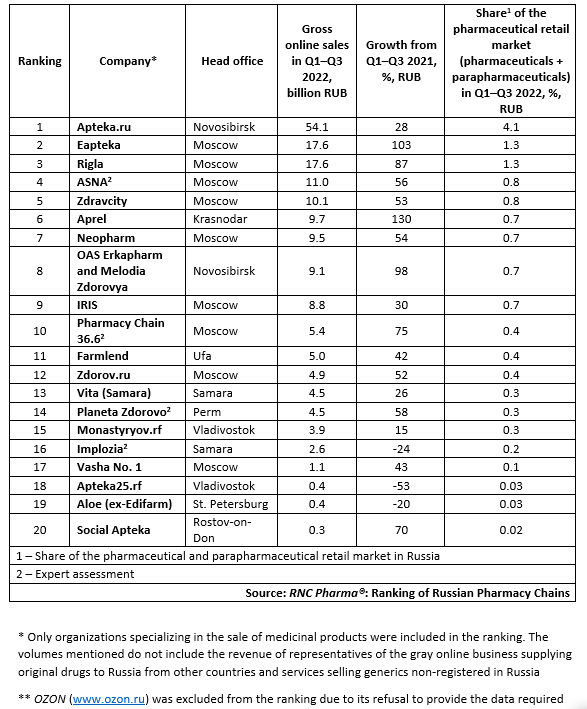

Top 20 Online Pharmaceutical Retailers in Russia (Q1–Q3 2022)

In Q1–Q3 2022, the online sales or reservations of pharmacy products (pharmaceutical drugs and parapharmaceuticals) in Russia were 213.4 billion rubles (end-user prices, VAT included), which is much higher than the total in 2021. The sales and reservations went up 50.7% (against 51.3% in Q1–Q2 2022). The growth rate is significantly more different from those seen due to the rush demand earlier this year—in particular, the sales in Q1 2022 grew 69.6%.

Online sales accounted for 16.3% of the total sales in the Russian pharmaceutical market in Q1–Q3 2022 against 13.3% in Q1–Q3 2021. In addition, the share of the top 20 companies was as high as 13.8%. The revenue of the top 20 companies totaled 180.5 billion rubles (end-user prices, VAT included) in Q1–Q3 2022, accounting for 84.6% of the online revenue in the pharmaceutical market. Still, the market share controlled by the top-tier enterprises was lower than that back in Q1–Q2 2022, since more and more second-tier companies are focusing on e-commerce now. Regional pharmacy chains that have a loyal pool of customers play a big role here—they can offer their customers a new service in the form of reservation or delivery of certain products.

As for the top companies, Aprel and Eapteka had the best growth rates—their sales went up 2.2 and 2 times against Q1–Q3 2021, respectively. Interestingly, the actual reasons behind those growth rates are somewhat different. Aprel has been implementing a program of large-scale regional expansion—in Q3, the chain grew by 748 pharmacies, meaning the company was opening around 11 new pharmacies every working day. Naturally, simply including new pharmacies in the online segment will attract a large number of consumers, especially if those pharmacies are promoted. Eapteka, on the contrary, has not changed the number of its offline pharmacies that much. Rigla is catching up with Eapteka—while it was somewhat behind the two companies in terms of growth rates, its market share is literally just a hundredth of a percent lower than that of Eapteka. The online project of Erkapharm and Melodia Zdorovya also had high growth rates—the project’s sales increased 98% from Q1–Q3 2021. The company developed its offline infrastructure as well, although the increase was not that dramatic—in July–September 2022, the number of the company’s pharmacies went up by 79.

However, online projects do not always focus on developing their offline infrastructure, especially since various organizations prioritize different development tasks. A clear example of this is large pharmaceutical associations.A number of them significantly increased the number of partners, in particular, 4,815 pharmacies joined Apteka.ru in Q3 2022—as of October 1, 2022, Apteka.ru worked with 31,334 pharmacies. However, the online sales of the company grew by only about 28% in Q1–Q3 2022. ASNA, which grew by only 18 pharmacies in Q3, increased its online sales by 56%. Another association, Zdravcity, had comparable growth rates of 53%, and the number of its partner pharmacies grew by 1,830.

Тop 20 Russian pharmacy chains and pharmaceutical associations with the largest online sales in Q1–Q3 2022**

Рус

Рус