RNC Pharma: Offline Veterinary Drug Sales in Moscow Oblast Fall 6% in January–May 2024

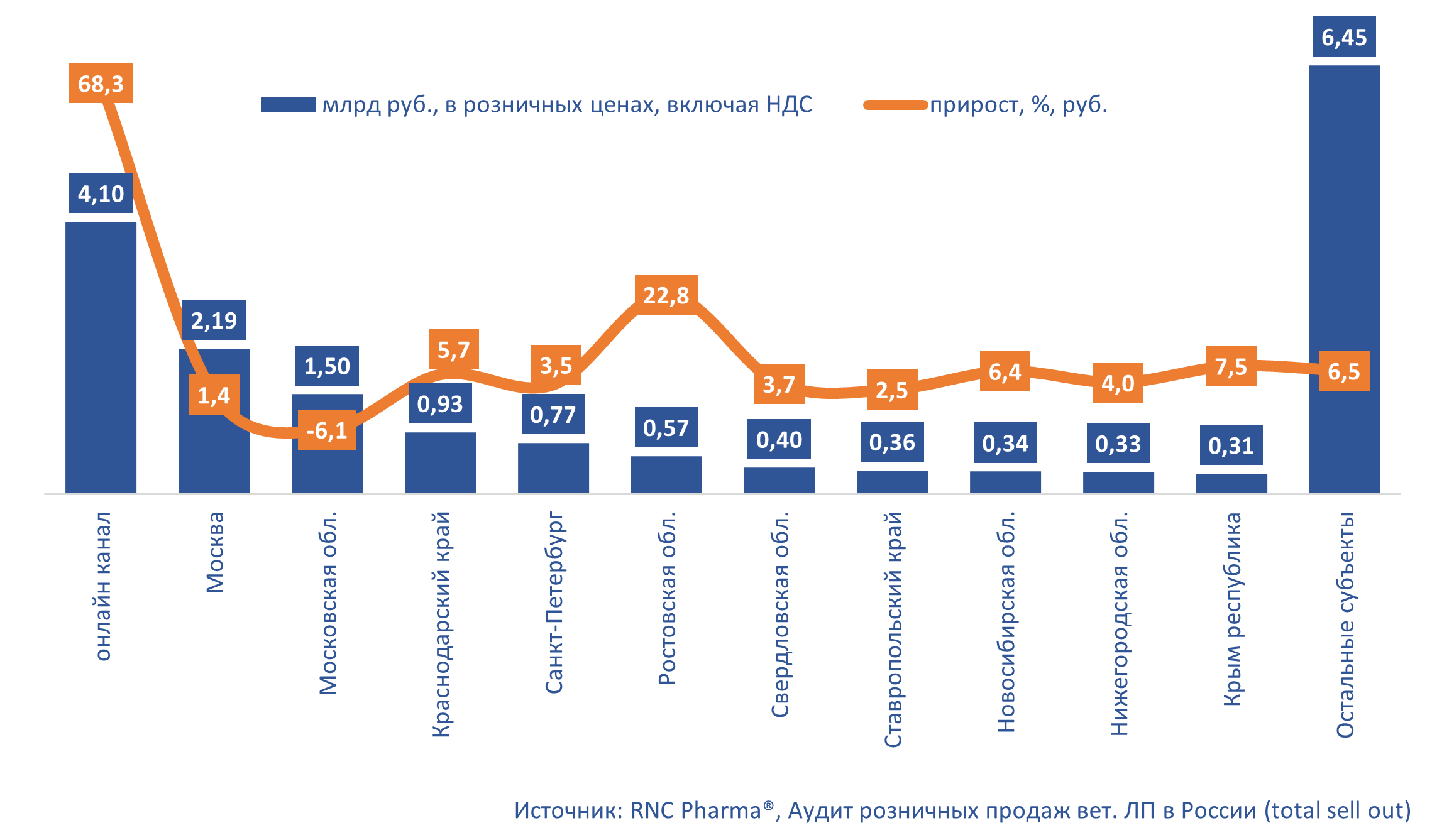

In January–May 2024, 106.6 million minimum dosage units (MDU) of veterinary drugs worth 18.3 billion rubles (retail prices, VAT included) were sold on the Russian retail market, up 14% in rubles and up 10.6% in MDUs from January–May 2023. While the growth rates were positive in both online and offline segments, e-com has been growing at a higher rate for the last few years. Online sales grew by 68.3% in monetary and by around 46% in physical terms, and offline sales went up 4.3% and 5.7% in rubles and MDUs, respectively. Naturally, the share of the online segment increased to 22.4% in monetary and to 16.2% in physical terms.

In offline pharmacies, 89.3 million MDUs worth 14.2 billion rubles were sold in January–May 2024. Moscow and Moscow Oblast accounted for 15.5% and 10.6% of the sales, respectively, while the other regions accounted for less than 7%. Krasnodar Krai ranked third with 6.6%, followed by St. Petersburg with 5.5% and Rostov Oblast with 4.1%.

Most of the analyzed regions, namely 74, saw a sales increase in monetary terms in January–May 2024. Among the top 10 regions, however, Moscow Oblast saw a 6.1% decrease in sales. The sales in Moscow went up by only 1.4%. As for physical terms, as many as four regions suffered a sales decrease, including Moscow Oblast (down 11.4%). The sales in Moscow fell 7.7% in MDUs, which seems to be a result of the customers switching to online shopping. Since the online segment in Moscow started to develop earlier than in the other regions, the decrease was not as sharp. In addition, the market here is significantly larger. Rostov Oblast recorded the highest growth of 22.8%.

The number of available brands varies from region to region. Among the 10 regions with the largest sales, Krasnodar Krai offered the highest number of brands, 1,046, while the smallest number, 715, was in St. Petersburg. The best-selling brands in monetary terms were not the same in every region as well. For example, Simparica by Zoetis was the best-selling brand in Moscow and Moscow Oblast, while the other top 10 regions preferred Inspector by Ekoprom, Bars by AVZ, and Bravecto by MSD.

In Moscow and Moscow Oblast, the two largest regions in terms of sales in rubles, the sales of Bravecto dropped by 67.5% and 75.2%, respectively. Moscow Oblast also saw a 32.9% decrease in the sales of Vetmedin by Boehringer and a 36.4% decrease in the sales of Apoquel by Zoetis, while the sales of both drugs grew in Moscow.

Fig. Ten Russian regions with the largest retail sales (e-com included) in monetary terms in January–May 2024, growth from January–May 2023

Рус

Рус