Pharmaceutical Drug Import to Russia (December 2022)

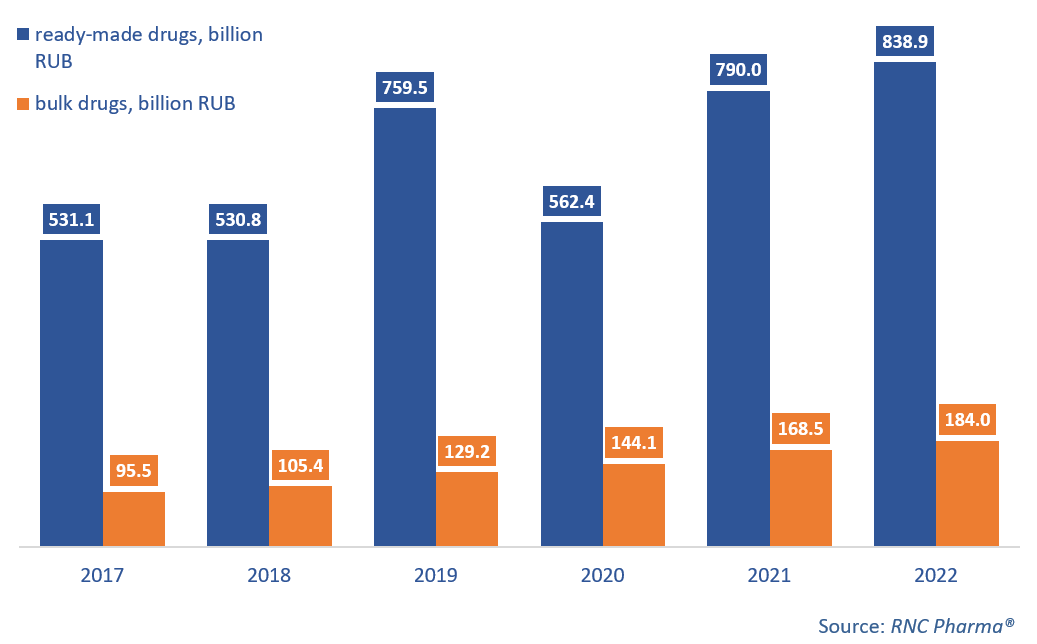

In 2022, Russia imported 838.9 billion rubles’ worth of ready-made pharmaceutical drugs (customs clearance and VAT included), up 6.2% from 2021. In physical terms, imports went down 8.7%, which is not that bad, considering all the sanctions, sharp demand fluctuations, and a very high base in 2021. As for bulk drugs, the import volume was 184 billion rubles, up 9.2% from 2021. In physical terms, however, imports decreased 34.3% in minimum dosage units (MDU), with 1.49 billion MDUs imported.

In December 2022, imports of both ready-made and bulk drugs dropped in monetary (by 8.3% and 10.3%) and physical terms (by 7.9% and 69%). The import of bulk drugs plummeting 69% is a twelve-month-low. This picture is not common for December, since the market usually tries to stock up on all the necessary goods before the New Year holidays, but December 2022 was up against November 2022 with its high level of activity, as well as December 2021 and its high base. As for bulk drugs, those foreign pharmaceutical companies involved in localization usually prefer importing APIs instead of bulk drugs.

The number of countries manufacturing ready-made drugs imported to Russia in 2022 remained the same—56. However, last year Russia imported ready-made pharmaceuticals from 52 countries, up 2 from 2021. Estonia and Turkey had the best growth rates—imports from these two countries went up 4.8 and 2.3 times against 2021, respectively. Both were more countries of transit than of manufacture; imports of Rowatinex by Rowa Pharmaceuticals (Ireland) and Theraflu by GSK (Great Britain) contributed to Estonia’s growth rates. As for Turkey, it helped import to Russia a number of those drugs by Johnson & Johnson that the company received after buying the portfolio of the Indian Unique—Dr. Mom, Rinzasip, Metrogyl, etc. Yet, Turkish manufacturers also increased their imports, in particular, the import by World Medicine went up several times thanks to Artoxan, Cocarnit, etc. Imports by the Netherlands dropped by as much as 32% because Opdivo by BMS is no longer directly imported—in 2022, it was imported to Russia only through Slovenia.

The number of countries importing bulk drugs did not change either—it is still 37, and the number of countries of transit was 30, down 3 from 2021. However, the role of certain countries has changed dramatically. For example, imports through Lithuania increased 2,614 times against 2021, mainly due to bulk imports by Novartis, in particular Risarg and Mekinist, which are packaged at Pharmimex’s Skopinpharm in Russia.

Growth rates of pharmaceutical imports to Russia (EEU countries excluded), free circulation prices, customs clearance and VAT included, RUB (2017–2022)

Рус

Рус