Database Update: Audit of Veterinary Drug Retail Sales in Russia (December 2020)

In 2020, the sales of veterinary drugs in the Russian retail market amounted to RUB 20.3 bln (retail prices, VAT included), which is in monetary terms (rubles) 0.2% lower than in 2019. The growth rate in physical terms (in minimum dosage units, MDU) is -3.4%, with the market volume of 191 bln MDUs.

Several factors at once affected the development of the veterinary market. First, the abnormal weather last spring and summer in a number of regions of Russia led to a noticeable reduction in demand for typical bestsellers, in particular for insectoacaricides and anthelmintics. Second, the coronavirus epidemic not only shifted the attention of consumers, but also seriously affected the income of the population, therefore limiting effective demand.

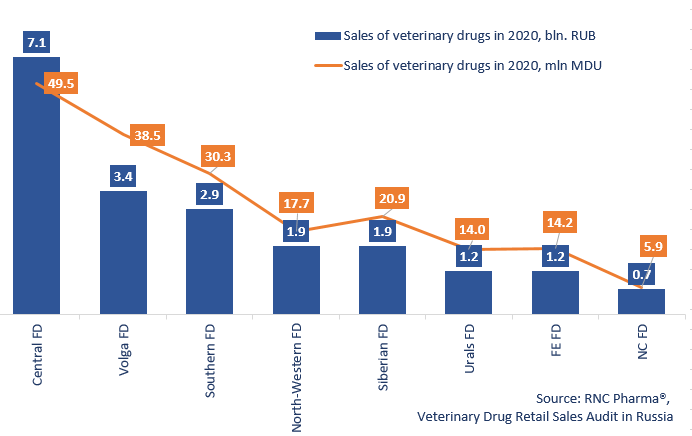

Of course, the global trends varied from region to region. For example, despite the general stagnation in demand, the growth rates in the Southern Federal District reached +9% in monetary and +10.5% in physical terms.

The Far Eastern Federal District also had significant growth rate in monetary terms (+10%), although in physical terms it was only +0.3%. The North Caucasian and the Northwestern Federal Districts showed the worst results: -17% in monetary and -24% in physical terms for the former and -10% and -14% for the latter.

It is noteworthy that in the Southern Federal District and the Far Eastern Federal District, the growth rates of the retail sales of drugs for pets and livestock were nearly the same, but in the Northwestern and the North Caucasian Federal Districts, the low sales of drugs for livestock were responsible for the drop in demand.

Agrobioprom had the best growth rates in monetary terms in 2020 among the top 15 companies (+44%). Its Pchelodar products for pets, together with insectoacaricide for bees Bivarool, contributed to the growth rates the most. KRKA and Zoetis also had high growth rates (+20% and +19%, respectively). Antiparasitic drugs for cats and dogs Selafort contributed to the growth rates of KRKA with a 4.6 times growth. As for Zoetis, the sales of combined vaccine Vanguard have increased by 3.6 times in monetary terms.

The three companies also have the highest growth rates in physical terms: Agrobioprom with +34%, Zoetis with +18%, and KRKA with +12%. Boehringer Ingelheim is also worth mentioning, with its +12%. The sales of the company’s tetracycline antibacterial drug Ronaxan, used for the treatment of infections in cats and dogs, have grown by 54%.

Regional structure and dynamics of the Russian retail market of veterinary drugs in monetary (consumer prices, VAT included) and physical (MDU) terms (2020)

Рус

Рус