RNC Pharma: Average Receipt in Veterinary Pharmacies Exceeds 1,000 Rubles in Moscow in Q1–Q2 2024

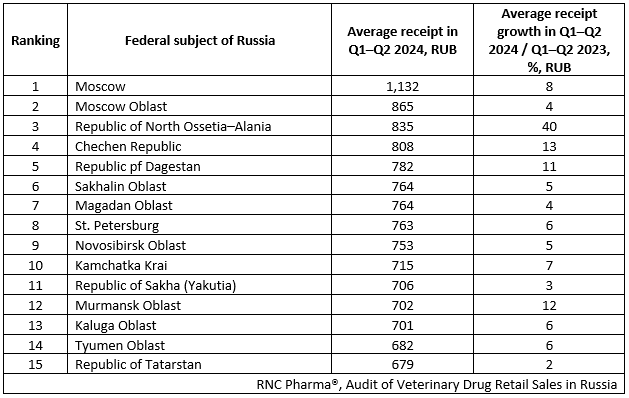

In Q1–Q2 2024, the average receipt in the veterinary retail market was 734 rubles, up 9.2% from the same period in 2023. The average receipt in offline veterinary pharmacies was lower, 646 rubles. In 28 Russian regions, however, it did not even reach 500 rubles. These regions include those of the Volga Federal District (FD), Siberian FD, and Far Eastern FD. Moscow saw the largest average receipt, 1,132 rubles, up 8% from Q1–Q2 2023, when it was 1,046 rubles.

Moscow was the only federal subject of the Russian federation where the average receipt exceeded 1,000 rubles, while the receipts in other regions were much lower. For example, Moscow Oblast ranked second with 865 rubles, up 4% from Q1–Q2 2023. At the same time, e-com is very developed in the central part of Russia, which basically prevents the average offline receipt from growing. Moscow and Moscow Oblast are followed by the regions of the North Caucasian FD and Far Eastern FD, which could partly be explained by a rather underdeveloped e-com in these regions. That is why most foreign-made drugs, which have significantly increased in price over the last two years, are purchased here in offline pharmacies. The average receipt is also affected by the organizational peculiarities of doing business in these regions.

In addition, in some North Caucasian regions, the average receipt grew significantly from Q1–Q2 2023. It went up 40% in the Republic of North Ossetia-Alania, up 24% in Saratov Oblast, up 19% in the Kabardino-Balkarian Republic, and up 18% in the Republic of Ingushetia. Interestingly, in the Republic of North Ossetia-Alania, the average receipt went up primarily due to the sale of drugs by two American manufacturers, MSD and Zoetis. These products are usually parallel imports, which affects the prices and, consequently, the average receipt.

In total, 72 regions saw an increase in the average receipt in Q1–Q2 2024. However, in 58 of them, it was relatively small, ranging from 1% to 10%. At the same time, the average receipt decreased in 13 regions, although by only 1% in most places.

Fig. Top 15 federal subjects of the Russian Federation with the largest average receipts in the offline veterinary retail market, RUB

Рус

Рус