Pharmaceutical Drug Production in Russia (July 2022)

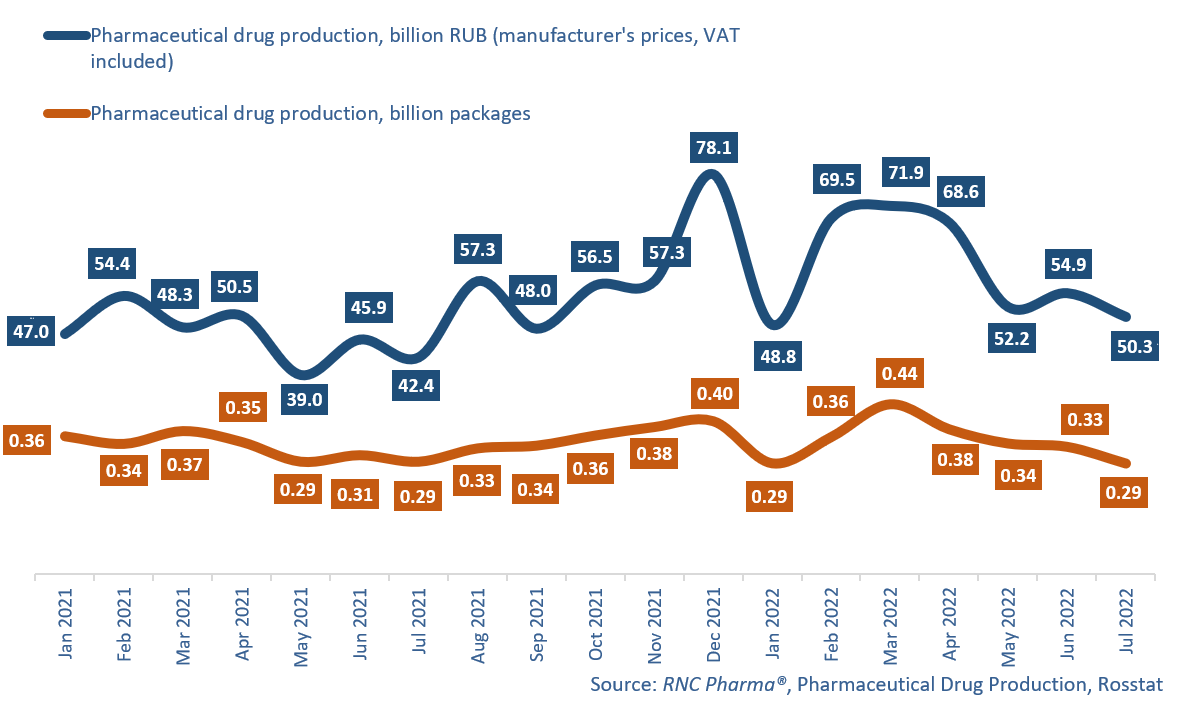

In January–July 2022, Russian manufacturers produced 416.3 billion rubles’ worth of ready-made drugs (manufacturer’s prices, VAT included), up 27.1% from the same period in 2021. In physical terms, the production volume was 2.43 billion packages, up only 4.9% from January–July 2021. If calculated in minimum dosage units (MDU), the volume was 46.1 billion MDUs, 2.5% up from January–July 2021.

The results of July 2022, 50.3 billion rubles, barely surpassed a seven-month low recorded in January, when there were only 16 working days. However, the growth rate in July was 18.6%. In physical terms, the growth rates were negative for the first time since January, –1.6% in packages and –2.9% in MDUs, with 289 million packages, or 5.6 billion MDUs manufactured.

Just as before, the growth rates in physical terms in January–July 2022 were determined by the manufacture of OTC drugs. While the production of OTC drugs went up 13.3%, the production of prescription drugs fell 3.5%. In MDUs, the growth rates for both groups are positive: 3.6% for OTC and 1.7% for Rx. Common drugs had the best growth rates among the top 50 OTC drugs in January–July 2022. The manufacture of Salicylic Acid grew 3.9 times (in packages) against January–July 2021, Formic Alcohol—3.2 times, and Hawthorn Tincture—2.9 times. All three drugs are produced by a fairly extensive list of manufacturers. For example, Salicylic Acid was produced by eight companies at once against six a year earlier; and only one of the eight manufacturers had a decrease in production. Yaroslavl Pharmaceutical Factory contributed to the growth rates of the product the most. As for those drugs outside the top, the manufacture of Kreon, at the facilities of Veropharm in Belgorod went up 8.5 times against January–July 2021. The production of Levomethyl by Zelenaya Dubrava (Dmitrov, Moscow Oblast) grew 4.6 times.

Two Pharmstandard brands had the highest growth rates among the top 50 prescription drugs—Combilipen (manufacture grew 2.6 times in packages) and Taufon (2.4 times). Golda MB by Pharmasyntez and Phenibut also had good growth rates—the manufacture grew 2.2 and 2.1 times, respectively. Phenibut was produced at 10 different enterprises, with Patent-Farm having the best growth rates. However, it is Tyumen Chemical and Pharmaceutical Plant that is responsible for the actual manufacture of the product. Outside the top, Salbutamol had the best growth rates (manufacture increased 4.9 times against January–July 2021); the drug was produced by four enterprises, with Semashko Moskhimfarmprepraty contributing to the growth rates the most. Again, the actual manufacturer of the drug was another company, Kirov Pharmaceutical Factory.

Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (January 2021–July 2022)

Рус

Рус