RNC Pharma: Nearly 43% of Brands Available in Less Than 1% of Russian Pharmacies

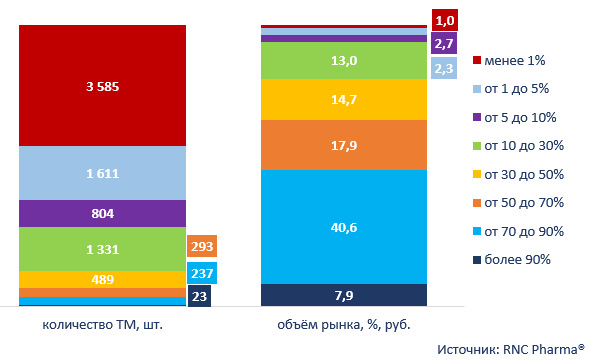

In January–May 2024, only 23 brands* were available for sale in every Russian pharmacy (a numeric distribution** of more than 90%), which is 0.3% of the total number of brands on the retail market. Despite their number, these 23 brands account for 7.9% of the retail sales in monetary terms and for 10.9% in physical terms.

At the same time, 42.8% of the brands on the market (around 3,600) are brands with a numeric distribution of less than 1%, accounting for only 1% of the sales in rubles and for 0.3% in packages. These brands include new launches, expected to grow in terms of distribution, and brands that are exiting the market as a result of the political situation or because they are the so-called “dogs”, meaning they measure low on both market share and growth.

Only 2.8% of the brands (237) have a numeric distribution of 70 to 90%, accounting for 40.6% of the sales in rubles and for 35.1% in packages. Less the 3.5% of the brands (293) are brands with a distribution of 50 to 70%; they accounted for 17.9% and 16.5% of the sales in monetary and physical terms, respectively. The brands with a distribution of 30 to 50% (489) account for 14.7% of the sales in rubles and 15% in packages.

The average price for one package of a product of the brand with a numeric distribution of more than 90% is between 99 and 783 rubles (retail prices, VAT included). These products belong to the average price category, with the price of one package at 398 rubles on the retail market in January–May 2024. The brands with the highest numeric distribution are Nurofen by Reckitt Benckiser, Pentalgin by OTCPharm, and Concor by Merck. You can find a detailed ranking of the brands with the highest distribution here: https://www.rncph.ru/news/28_06_2024

The prices of the rare brands, those with a numeric distribution of less than 1%, range from 10,000 to 600,000 rubles, because these brands include niche and high-priced products, which are usually paid for by the government.

The brands accounting for more than 40% of the sales (with a numeric distribution of 70 to 90%) include those with the most stable growth rates, for example, Xarelto (Bayer), Eliquis (Pfizer), and Edarbi (Stada). However, those products that are typically used to stock up medicine cabinets at home have the highest numeric distribution, in particular Nasivin (Procter & Gamble) and Lysobact (Bosnalijek). The prices for a package of the drugs in this category ranged from 23 to 3,700 rubles in the analyzed period.

Fig. Structure of the Russian retail pharmaceutical market: brands** and numeric distribution in January–May 2024

Рус

Рус