Pharmaceutical Drug Import to Russia (April 2020)

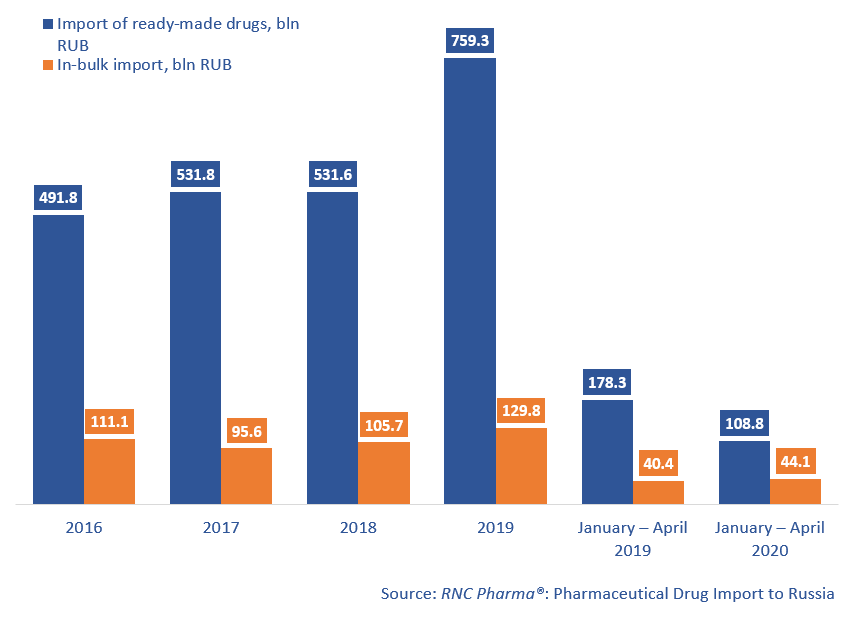

Between January and April 2020, Russia imported 108.8 bln RUB worth of ready-made pharmaceutical drugs (customs clearance and VAT included), which is in monetary terms (rubles) 39% lower than in 2019. The in-bulk import amounted to 44.1 bln RUB, with the dynamics of +9%.

Despite the negative dynamics of the import of ready-made drugs, the situation is on its way to stabilization and usual seasonal trends. (Since the market expected a labeling system, those trends have been distorted.) The dynamics in monetary terms in April 2020 are +8%, -38% in March, -60% in February, and a record-worthy - 63% in January.

The import of ready-made drugs in physical terms between January and April 2020 amounted to 272.8 mln units, with the dynamics of -51.4%. If calculated in minimum dosage units (MDU), the volume is 6 bln MDUs, with the dynamics of -44.6%. Still, the dynamics in April 2020 are much better than the average dynamics in Q1 2020. Despite the positive dynamics in monetary terms, the dynamics of the in-bulk import are -30.4%, with 702 mln MDUs.

Three top 15 importers of ready-made drugs showed multiple growth rates. SG Biotech has the highest dynamics in monetary terms (imports grown by 3.7 times), the company’s Advate and Feiba contributes to the dynamics. SG Biotech is followed by Biogen Idec (imports grown by 3.4). The import of Spinraza, drug for the treatment of spinal muscular atrophy, which was not imported to Russia a year earlier, made the dynamics. Biomarin Pharmaceutical, which did not import to Russia between January and April 2019, has also tripled its imports. Its Naglazim accounted for a bigger part of the import, while Vimizim contributed to the dynamics the most.

As for in-bulk drugs, Astellas, followed by Eisai, has the highest dynamics among the top 15 companies (imports grown by 4.7 in monetary terms). Flemoxin Solutab and Ribomustine contributed to the company’s dynamics. Both drugs were not in-bulk imported to Russia last year, but now secondary packaging resumed at Ortat in the Kostroma region. Eisai has increased its imports by 3.2 times. Between January and April 2020, the company imported anti-tumor Lenvima and Halaven, packaged by Pharmstandard in Ufa.

Dynamics of import of pharmaceuticals to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT, RUB (2016 – 2019, January – April 2020)

Рус

Рус