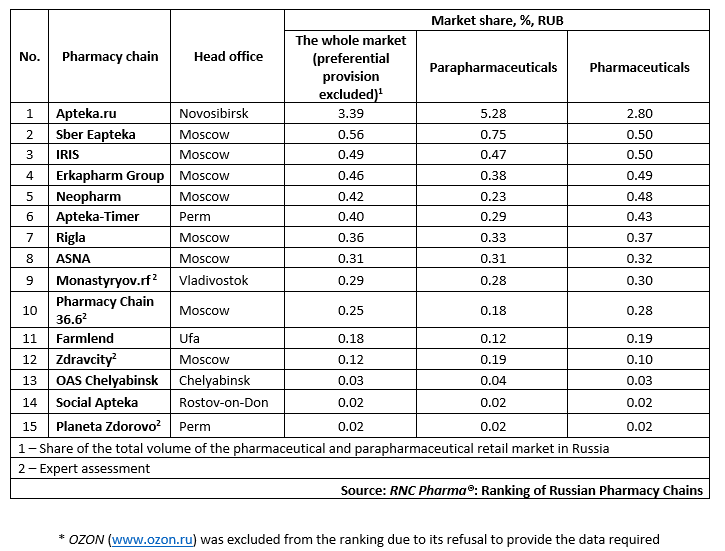

Top 15 Online Pharmaceutical Retailers in Russia (2020)

In 2020, the total volume of online sales or reservation of medicinal products (pharmaceutical drugs and parapharmaceuticals) in Russia amounted to RUB 137.5 bln (end-user prices, VAT included), which is 9.3% of the market volume. The e-commerce segment in this ranking is represented only by organizations selling medicinal products on a regular basis; these volumes do not include the revenue of gray online businesses importing original drugs to Russia from other countries, as well as services selling generics unregistered in Russia.

In the analyzed period, the total sales volume of the top 15 companies amounted to RUB 108 bln (end-user prices, VAT included), which is nearly 78.5% of the online pharmaceutical sales. The share of the top 15 companies has dropped by 0.01% since the third quarter, which is a sign that the companies out of the top 15 has been actively developing, too. Apteka.ru is still the absolute leader of the segment, with the share of 2.8% of the market in monetary terms. The remaining 14 companies account together for 4.02%. It is noteworthy that the company's share in the market of parapharmaceutical products sold in the pharmaceutical retail has risen to a record 5.28%. The rest of the top companies account only for 3.6% of this market.

Zdravcity is also worth mentioning, having come 12th with the share of 0.1% in the pharmaceutical and 0.19% in the parapharmaceutical retail. Most companies in the top (11 out of 15) focus on the development of their pharmaceutical product range. Apart from Apteka.ru and Zdravcity, only Sber Eapteka (top 2) and Regional Pharmaceutical Warehouse / OAS (Chelyabinsk) (top 13) pay attention to parapharmaceuticals.

The IRIS partnership is the last company to note; its share in the pharmaceutical retail is comparable to that of Sber Eapteka (0.5%), but due to the smaller number of operations with parapharmaceuticals, the company’s final score is lower. However, the organization has been actively developing, in particular, Farmaimpex, one of the largest players in the Russian pharmaceutical retail, joined the partnership in January 2021, that is why the ranking is sure to change in the near future.

NeoPharm focuses on the pharmaceutical retail the most among the top online companies, coming 5th with a 0.48% share in the pharmaceutical retail market in 2020.

Тop 15 Russian online pharmaceutical retailers in 2020*

Рус

Рус