Pharmaceutical Drug Production in Russia (December 2022)

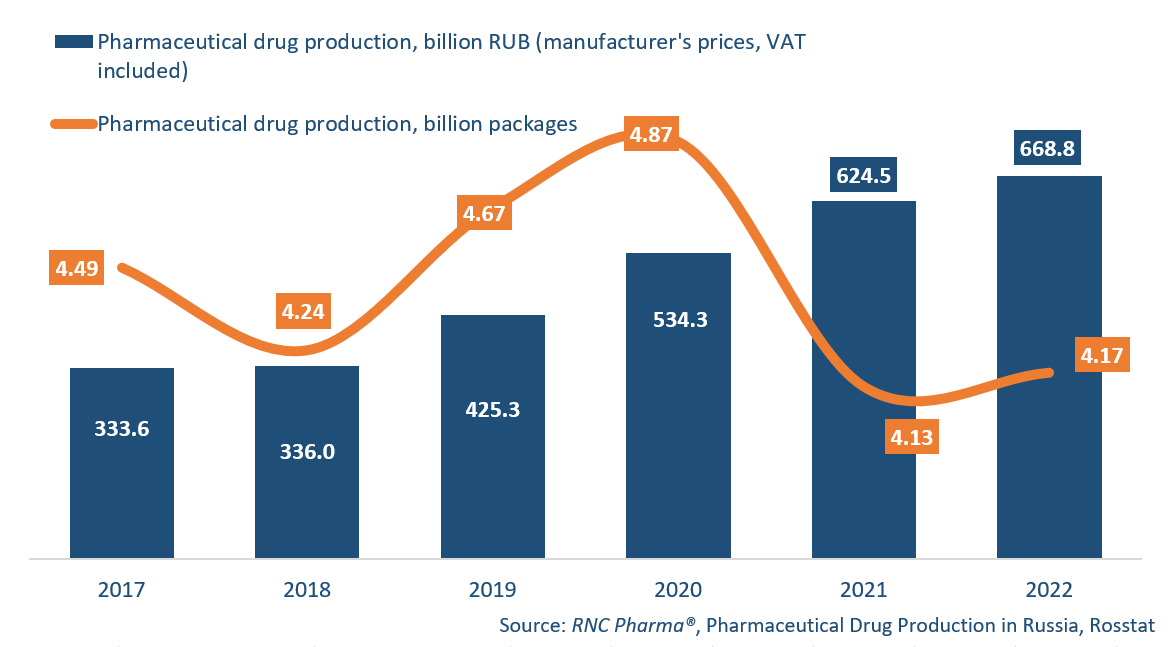

In 2022, Russian manufacturers produced 668.8 billion rubles’ worth of ready-made pharmaceutical drugs (manufacturer’s prices, VAT included), up 7.1% from 2021. In physical terms, the manufacture went up only 1%, with around 4.17 billion packages produced. The average package remained more or less the same, which is why the growth rate in minimum dosage units (MDU) was 1.7%, with 79.6 billion MDUs manufactured. December 2022 saw one of the worst results in the past 12 years—51.7 billion rubles’ worth of ready-made drugs, down 33.8% from December 2021. In physical terms, the manufacture went down 10.4% In packages and 4.6% in MDUs—not the worst result, but telling, because the comparison period was highlighted by the pandemic and 2022 saw various consumption patterns.

The number of manufacturing companies in 2022 was 432, up 29 from 2021. However, not all the companies have their own production facilities, often acting only as holders of registration certificates. Among the new companies, OOO Treugolnik, based at Renewal in Novosibirsk, and OOO Mikfetin, based at Vips-Med in Moscow Oblast, accounted for the largest production volumes in 2022. The assortment also continued to grow—from 1,348 in 2021 to 1,436 INNs in 2022, and from 2,640 in 2021 to 2,823 brands in 2022.

As for prescription drugs, the manufacture went down 5.5% in packages. Yet, with the average package somewhat changed, the manufacture was up 0.6%, if calculated in MDUs. The combination of levodopa and carbidopa had the best growth rates in 2021—its production went up 342 times in packages against 2021, in particular, thanks to the start of local production of the drug Nakom by Novartis at its plant in St. Petersburg. Triptorelin is another striking example—its manufacture increased 20 times against 2021, since the production of Triptorelin-Long was launched at the Pharmstandard enterprise in Ufa (the drug was previously produced at the Nativa enterprise in Moscow Oblast).

The production of OTC drugs increased 7.2% in packages—if calculated in MDUs, the growth rate is more modest, 2.9%. Rauwolfia alkaloids, produced by Vifiteh (Raunatine), had the best growth rates in this category—its manufacture grew 15.7 times against 2021. Rauwolfia alkaloids are followed by the combination of algeldrate and magnesium hydroxide. While it was produced by three manufacturers at once, AVVA Pharmaceuticals with its Malvacid and PharmVILAR with Bi-Coden contributed to the growth rates the most. Nonoxynol rounds out the top three with its growth of 9.9 times—produced in Germany, it is packaged at Altpharm in Moscow Oblast.

Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (2017–2022)

Рус

Рус