RNC Pharma: Active Investment Phase May Pose a Risk for Pharmacy Associations

In the first six months of 2024, the Russian pharmaceutical retail market grew by as much as 16.9%. The sales of parapharmaceuticals went up as well, while the total revenue of Russian pharmacies was 1.04 billion rubles (retail prices, VAT included). Higher household incomes and inflation rates contributed to the growth rates. The average receipt grew as well, thanks to pharmaceutical sales, and it was 686.4 rubles in Q1–Q2 2024, up 12.5% from Q1–Q2 2023.

At the same time, consumers of parapharmaceuticals are starting to shop online more often. That is why the sales of parapharmaceutical products in pharmaceutical retail grow mostly due to inflation. In addition, some categories have almost completely disappeared from pharmaceutical retail, and others are following suit. These trends directly affect the profitability of pharmaceutical retail, which is under pressure from the rapidly growing payroll costs and rising rental rates, apart from a reduced front margin.

All that does not lead to mass closure of pharmacies yet, thanks to high demand and solvency and opportunities to obtain back margin. Back in 2023, ten large foreign AIPM companies cut payments to Russian physicians by nearly 17%. On the one hand, this significant cut can be explained by updated portfolios and a revised way of doing business in Russia. On the other hand, it means a redistribution of marketing costs at the expense of other areas, including promotion in pharmacy chains and associations. At the same time, their methods of choosing partners in retail and monitoring marketing effectiveness are becoming increasingly strict.

Meanwhile, several large associations and aggregators, such as ASNA, Apteka.ru and Zdravcity, lost a certain number of pharmacies in Q2 2024. However, this does not seem like an avalanche-like process yet and may rather be a result of the increased activity of Puls and its Polza.ru project.

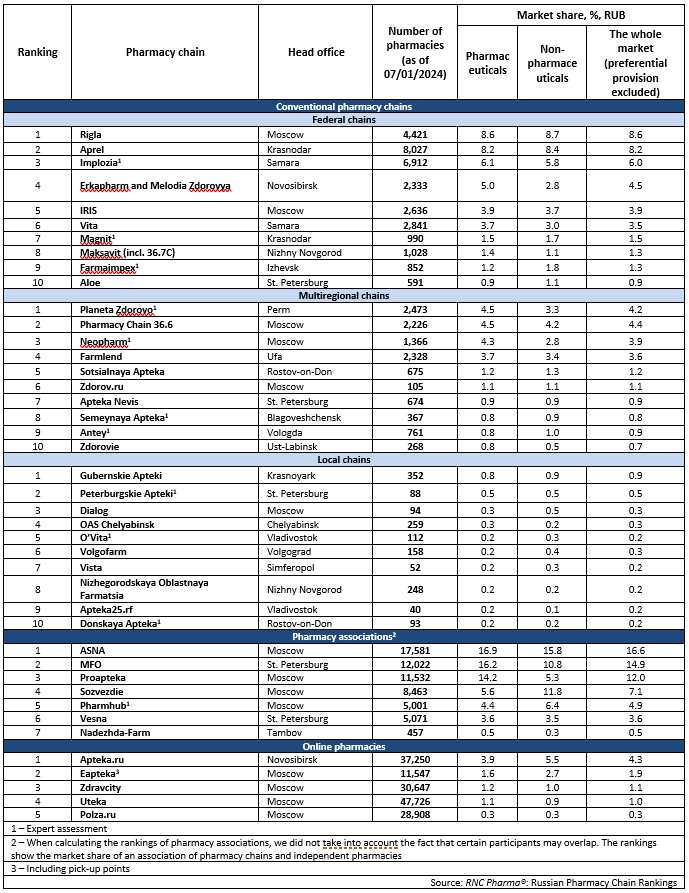

Tab. Top pharmacy chains in the Russian pharmaceutical retail market (Q1–Q2 2024)

Рус

Рус