RNC Pharma: Product Range and Promotion Changes in Store for Pharmaceutical Retail in First Half of 2023

Last year, the Russian pharmaceutical retail industry went through a long period of stress, from the spring rush demand to demand plummeting in the fall and winter. Still, the market grew 14.6% from 2021 in rubles. 2023, however, did not start with any remarkable achievements: demand together with household incomes continues to drop, and the market is unlikely to start growing again until the second half of the year without external incentives, taking into account the peak sales figures in the spring of 2022.

The development of the online channel is likely to slow down this year as well. While the growth rates are expected to be significantly higher than those of the offline, the overall growth potential of the segment is close to exhaustion, and the growth rates of the two channels will eventually even out. This can be indirectly confirmed by a slight shift in the investment priorities of major market participants, mainly projects associated with pharmaceutical distributors, which in recent months have been paying increased attention to production. Also, the infrastructure of a number of pharmacy associations in late 2022 either is hardly developing or completely stopped. While an experiment with the online sale of prescription drugs was formally launched on March 1 (initially, market participants had high hopes for it), many regions turned out not to be ready for it, with many open questions in the corresponding legislature being one of the reasons.

The product range on the pharmaceutical market has not yet returned to what it used to be, either. Suspended Viagra imports are a great example here, showing that the drug has long stopped being a backbone for the retail market and also at one moment became a niche product that was almost completely replaced by direct and indirect alternatives. Still, before the crisis, there were many examples when the original drug was considered a premium product with dozens of generics for many years. In this sense, times have changed dramatically, and this a clear sign that the business policy has been seriously revised—even by those companies that have nothing to do with the sanctions.

In addition, a full-scale launch of the dietary supplement labeling system is in the works. The experiment was successful, which will most likely be followed by a serious revising of the product range on the market, like it was after the drug movement monitoring system was launched. A rather extensive list of products is at risk, primarily those brands that are currently sold on marketplaces. A certain number of customers returning to the pharmaceutical retail (both offline and online) might be a pleasant bonus, but the process can still hardly be forecasted.

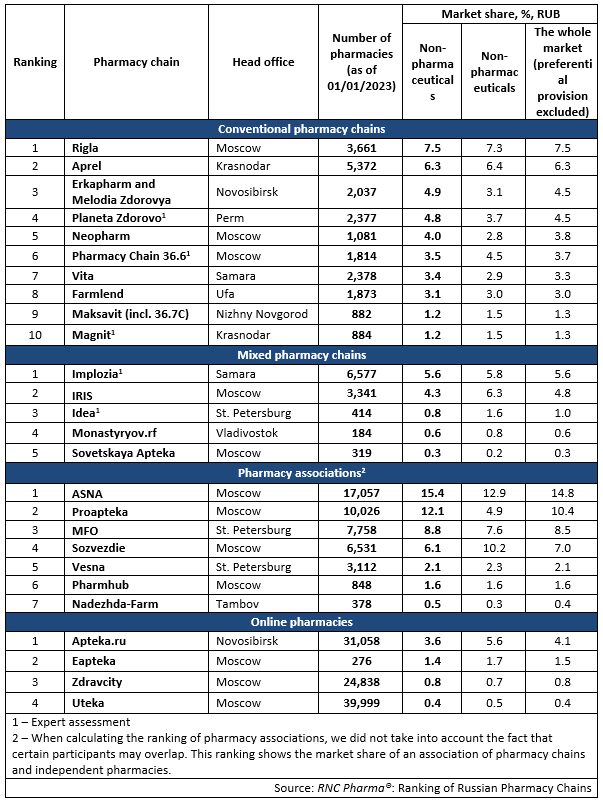

Tab. Top pharmacy chains in the Russian pharmaceutical retail market (2022)

Рус

Рус