Ranking of Russian Pharmaceutical Distributors (Q1–Q2 2022)

The pharmaceutical industry survived the spring crisis with practically no losses, even though nearly every market participant was affected to some extent. Pharmaceutical distributors, depending on the market the most, could not avoid the changes during the acute phase of the crisis, but with the pharmaceutical market dodging any harsh sanctions, the wholesale market quickly returned to normal.

At the same time, the Russian economy did undergo serious changes due to sanctions and the reactions of certain market participants. Those changes affect household incomes, therefore determining demand prospects. Household incomes are most likely to hit 1-year low in the second half of the year, which means that wholesalers working with the retail should not expect any growth. For the first time since 2020, the growth rates for the pharmaceutical retail in Q2 2022 were negative. However, the further prospects seem relatively positive so far, with no market participant forcing the retail to collapse. Yet, the roles, as well as the risks for B- and C-tier companies, will still change. In addition, some large wholesalers are increasing their investments in the retail, including Puls, the last of the top three players to launch its own aggregator / online pharmacy.

Wholesale companies are still investing in the core infrastructure, despite the fact that cooperation with a number of European suppliers of warehouse equipment and software now either is impossible or has become much more difficult. Since this kind of pressure may clearly have a global long-term effect, market participants started to look for alternative suppliers in China and other regions. Wholesalers invested in other areas as well. For example, R-Pharm acquired a controlling stake in OOO 1ER, a developer of electronic prescriptions. This could be useful for the e-com sphere, which Aleksei Repik is interested in as well, and the developer can obviously expect a more global role in the Russian pharmaceutical market when the online sale of prescription drugs is finally allowed.

The COVID-19 factor also remains relevant, since an increased incidence when, theoretically, herd immunity drops can lead to very unpleasant consequences for the healthcare system. However, as long as there is hope that peak incidence rates are mild, rush demand is hardly possible. As for public procurement, the current activity indicates that the investments are unlikely to be those of 2020–2021. Yet, demand is still likely to rise this fall, maybe even partly balancing the decline caused by the falling household incomes. The state guarantee program for other diseases remains open, and officials are now concluding more long-term contracts, which is also a kind of stabilizing factor, albeit concerning a relatively narrow list of drugs and companies.

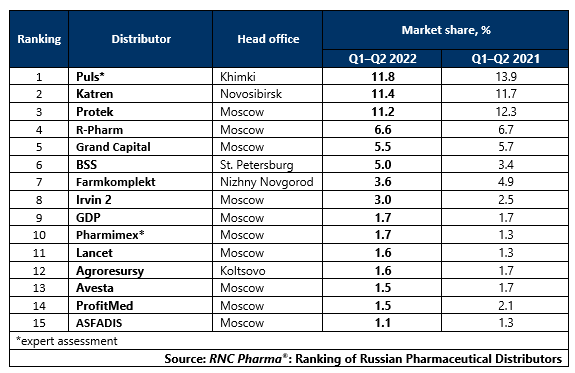

Tab. Top 15 pharmaceutical distributors with the largest market shares of direct pharmaceutical drug shipments (including preferential regional shipments), in monetary terms (Q1–Q2 2022)

Рус

Рус