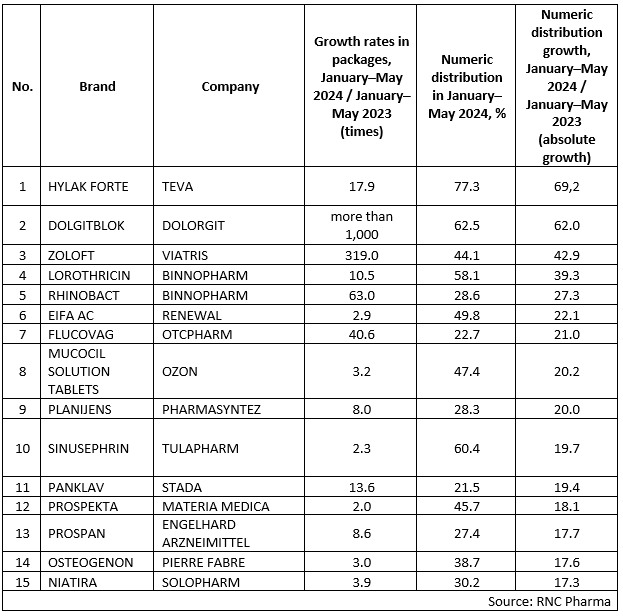

RNC Pharma: Ranking of Pharmaceutical Drugs with Highest Distribution Growth (January–May 2024)

In January–May 2024, products of around 8,400 brands, including unbranded products of various manufacturers, were on the market. At the same time, only 553, or 6.6% of those brands were available in more than half of Russian pharmacies (a numeric distribution of more than 50%). We thought it was important to analyze the brands with a numeric distribution increase in January–May 2024, given that they accounted for only around 22% of the total number of brands. In addition, some 200 brands had a more than 5-percent increase, and the distribution of only nine of them went up by more than 20%. The drugs with the highest numeric distribution, however, did not see any significant change in availability.

The products with the highest absolute distribution growth include brands that suffered temporary suspension of imports or supply disruptions, for example, the probiotic Hylak Forte by Teva and the antidepressant Zoloft by Viatris. Hylak Forte was available in only 8.1% of pharmacies in early 2023 against 77.3% in early 2024, when imports were resumed. Imports of Zoloft were also temporarily suspended in October 2022, resulting in the distribution of the drug falling to 1.1% in January–May 2023, and then resumed in the second half of 2023, allowing the distribution to go back to 44.1%.

There were several other similar examples among the top 15 brands, such as the cough syrup Prospan and the antibiotic Panklav. Prospan was not in circulation from the second half of 2020 to April 2023, according to Roszdravnadzor.

The ranking also included brands that have appeared on the Russian market recently and have been actively increasing their availability, in particular the non-steroidal anti-inflammatory drug Dolgitblok by Dolorgit (registered in 2022, in circulation since April 2023). While the distribution was very low (0.5%) at the start of sales due to the small volumes of the drug, it increased to 62.5% in early 2024. Another two products with a significant distribution increase are drugs for ENT diseases, Lorothricin (up 39.3%) and Rhinobact (up 27.3%) by Binnopharm.

Interestingly, nine of the drugs among the top 15 products are Russian brands. These brands include both recent launches, in particular Niatira by Solopharm, and older products, for example Eifa AC by Renewal, which has been on the market since 2019.

Increasing distribution naturally increases sales. For example, the sales of Hylak Forte in January–May 2024 went up nearly 18 times in physical terms, the sales of Dolgitblok increased more than 1000 times, and the sales of Zoloft went up 319 times against January–May 2023.

Fig. 15 brands with the highest numeric distribution in January–May 2024

Рус

Рус