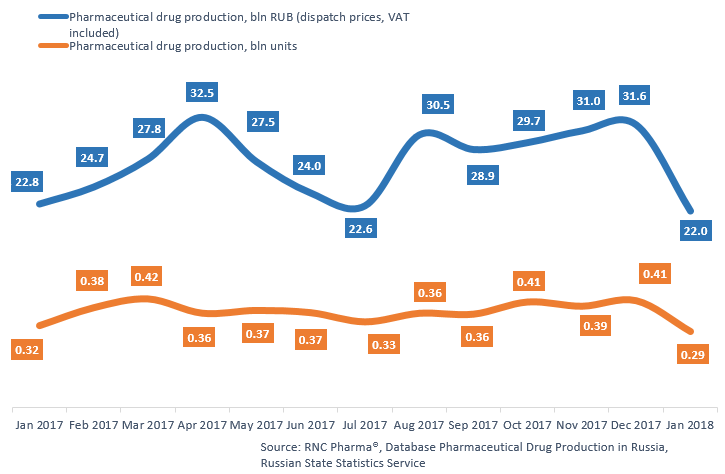

Database Update: Pharmaceutical Drug Production in Russia (January 2018)

The new year for the Russian pharmaceutical industry did not start that well. In January, Russia dispatched 22 bln RUB worth of pharmaceuticals (dispatch prices, VAT included) to the market, which is in monetary terms 3.4% lower than that of January 2017. The growth rates in physical terms are even worse, with a 7.2% decline and 0.29 bln units. The decline was largely due to over-the-counter drugs, with a 13% decline over the year. The dispatch of the Rx category has risen by 4%, though.

The top 3 companies has shown a decline in dispatch, with a few percent difference between the companies. Pharmstandard has become the leader in production, while the dispatch has fallen by 11%. The dispatch by Ozon and Tatkhimfarmpreparaty (second and third place) has fallen by 13% and 14%, respectively. Among the top 10 companies, Irbitsky KhFZ has shown the best progress, with a 62% rise.

Non-branded drugs, which are produced by several manufacturers, have shown the biggest decline in dispatch. Among the top 10 trademarks, Analgin (Pharmstandard and Dalkimfarm) showed the biggest decline in January. Strangely enough, non-branded products have also shown the biggest rise, in particular, the dispatch of Ceftriaxone (Promomed RUS and Ruzfarma) has increased by 79% (in units) over the year.

Dynamics of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (January 2017 – January 2018)

Рус

Рус