Pharmaceutical Drug Production in Russia in 2023

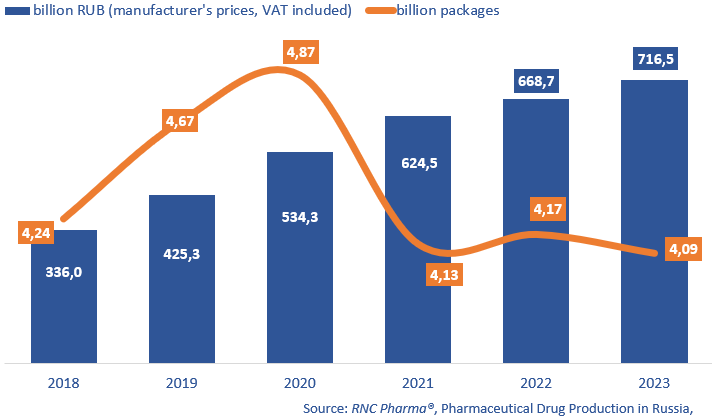

In 2023, Russian manufacturers produced 716.5 billion rubles’ worth of ready-made pharmaceutical drugs (manufacturer’s prices, VAT included), up 7.2% from 2022. In physical terms, it was 4.09 billion packages, down 2% from 2022. However, with the unusual behavior of consumers and other market participants, these results may be good enough. If calculated in minimum dosage units (MDU), the manufacture grew 1.2% from 2022, with more than 80.6 billion MDUs produced.

In December 2023, Russian manufacturers produced 67.1 billion rubles’ worth of ready-made pharmaceuticals, up 20% from December 2022, which is quite high but not as high as in November 2023. In physical terms, it was 372.7 million packages, up 4.4% from December 2022. Interestingly, 2023 saw positive growth rates six times, and only in the second half of the year. If calculated in MDUs, 7.49 billion was manufactured, up 5% from December 2022.

Pharmaceutical drugs of 1,483 INNs and 2,964 brands were manufactured in Russia in 2023, up 45 and 141 from 2022, respectively. The number of SKUs was 10,456, up 591 from 2022. Mainly prescription drugs helped develop the product range; the number of SKUs went up 502 from 2022. In physical terms, the manufacture of Rx drugs grew 3%, while that of OTC drugs dropped 6.2%.

380 companies produced prescription drugs in 2023, up 28 from 2022, despite the fact that a number of manufacturers suspended its activities. In particular, GSK stopped packaging a number of its vaccines; the vaccines were packaged at SmithKlein Beecham-Biomed in Petrovo-Dalneye, Moscow Obslat. Elpida had the best growth rates in 2023; its manufacture of anti-HIV prodrug Elpida increased 15.6 times against 2022. Elpida is followed by Ever Pharma; the latter increased the manufacture of its Cerebrolysin, produced in partnership with Russian Sotex. NovaMedica increased its production 6.1 times against 2022; the company’s anti-migraine drug Relonova and sleeping pills Levroso contributed to the growth rates the most.

As for OTC drugs, 190 companies manufactured ready-made drugs in 2023, up 4 from 2022. Just like with manufacturers of Rx drugs, a number of companies suspended certain activities. In particular, Johnson & Johnson suspended the manufacture of Motrin at Akrikhin in Moscow Oblast. Artelar had high growth rates; its production went up 21.3 times in physical terms against 2022. The manufacture of Ridovakan (potassium aspartate and magnesium aspartate) and venotonic Roklis contributed to the growth rates the most. Pharmasyntez increased its manufacture 15 times against 2022, with NSAIDs and analgesics, in particular, Nexemezin, Nuralgon and Ibuprofen, contributing to the company’s growth rates.

Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (2018–2023)

Рус

Рус